News

Singapore's barely a choice for new investments in 2013

Singapore's barely a choice for new investments in 2013

Nearly 1 in 2 investors in Singapore stay on the sidelines.

Here's how wealthy Singaporeans invest compared with Hong Kongers and Swiss

Singapore gentlement don't prefer bonds.

14 local SMEs get additional funding from NTUC

Over 100 grads and diploma holders to benefit.

StarHub's NucleusConnect to gain $100m rollout grants by 2018

But it is still a conservative forecast.

Volumes for all of Olam's segments rose except for this one

It blames a shipment delay.

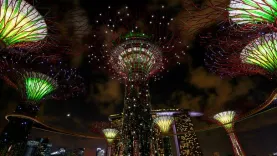

Gardens by the Bay among world's coolest futuristic buildings

Check out these other infrastructure eye candies.

Keppel Offshore & Marine to deliver 22 newbuilds in 2013

It's a record high.

The Postman shelled out $179m on acquisitions

But earnings on acquisitions still top secret.

SingTel's corporate data niche threatened by StarHub

The latter's 20% market share could balloon anytime.

Chart of the Day: Singapore to have 61,100 more foreigners by 2015

But local citizens will only increase 20,000.

Daily Briefing: iPhone losing Singapore market; Singaporean owns first F1 stimulator

And check out these valentine's hotspots for singles.

MayBank says Olam's existing strategy 'internally flawed'

Net profit was just similar to finance cost.

The telco industry will soon witness a new twist

Singtel to soon lose corporate data race to StarHub.

Petra 'petra-fied' by looming loss on cocoa division

No thanks to US$13.5m provisions.

Competition heats up for Singapore Airlines as Middle-Eastern carriers expand presence

SIA increases frequency of flights to Australia.

Great Eastern Holdings smokes the competition in Malaysia

Higher premium products sales surged 30%.

Ascott ready to pounce with $300m war chest

More acquisitions to date.

Advertise

Advertise

Commentary

Liquidity crucial to stock market reform

From ownership to access: Unlocking vehicle productivity in Singapore

Why Singapore schools need AI policies now: A chemistry teacher’s warning