Keppel DC REIT NPI up 47.6% to $62.37m in Q3

DPU for the quarter is 2.357 cents, more than 22% higher than in Q3 2019.

Keppel DC REIT’s net property income (NPI) hit $62.37m in Q3, 47.6% YoY higher than Q3 2019’s $42.27m, according to an SGX filing. Gross revenue also climbed 46% YoY to $67.67m in the same quarter.

Distributable income also rose 47.6% YoY to $40.5m in Q3, whilst distribution per unit (DPU) increased 22.1% YoY to $0.02357.

The REIT currently has a portfolio occupancy of 96.7%. Portfolio WALE is at 7.2 years by leased area.

Just this October, Keppel DC REIT was included in the benchmark Straits Times Index (STI).

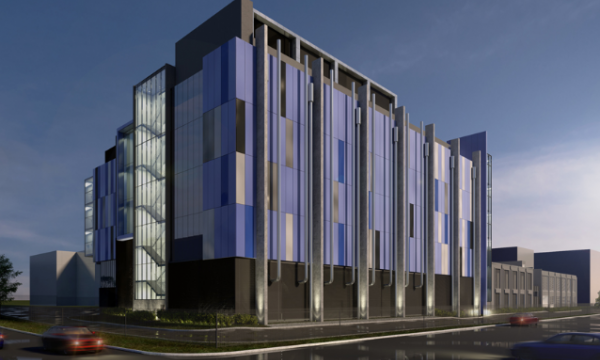

Moving forward, the REIT outlined several asset enhancement works estimated to finish in H1 2020. These include the A$26-36m acquisition of Intelligence 3 East Data Centre (IC3 East DC) in Sydney, which has a 20-year triple net master lease with Macquarie Telecom; and Keppel DC Singapore 5, which involves the conversion of vacant non-DC space to DC space, amounting to about $29.9m.

Advertise

Advertise