Commercial Property

Digital Core REIT’s NPI down 2.3% YoY in Q1

Digital Core REIT’s NPI down 2.3% YoY in Q1

Its net property income (NPI) declined to US$17.4m ($23.2m).

Divestment of Daikanyama hits Starhill Global REIT’s NPI

The net property income (NPI) declined 1.3% YoY in 3Q FY22/23.

Chart of the Day: Shophouse sales volume down 46% YoY in Q1

It went down to 28 deals in the first few months of the year.

IREIT Global portfolio occupancy dips to 87.0% QoQ

But its rental rate grew to 3.4%

Suntec REIT’s distributable income drops 26.8% YoY to $50.3m in 1Q23

Given the drop, it recorded a 27.4% YoY lower DPU to unitholders.

FCT’s net property income rises 5.7% YoY to $137.96m in 1H23

Despite the increase, it recorded a 0.1% YoY lower DPU of $0.06130.

ESR-LOGOS REIT net property income soars 78.2% to $70.4m in 1Q 2023

The contributions from ARA LOGOS Logistics Trust after its merger drove the growth.

CapitaLand Ascott Trust’s gross profit grew nearly 60% YoY in Q1

New properties’ operating performance led to growth.

Parkway Life REIT’s NPI up 23.5% YoY in Q1

The real estate firm’s net property income (NPI) grew to $35.2m.

First REIT net property income up 2.7% YoY to $25.8m in Q1 2023

This is supported by the full quarter contribution of its Japanese nursing homes.

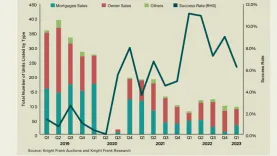

Chart of the Day: Auction listings down 3% QoQ in Q1

The seasonal lull from the New Year led to the decline.

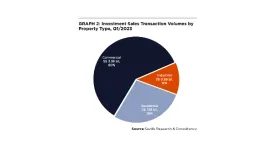

Chart of the Day: Commercial sector dominates investment sales transactions in Q1 2023

The sector saw a total investment sales of $3.38b

CapitaLand Ascendas REIT to divest 7-storey industrial building

KA Place is up for sale for $35.58m

Asset-light strategy leads Ascott to 160,000-unit target

The company also focused on securing prime properties to double its fee revenue.

Chart of the Day: Top investment sectors of HNWIs in Singapore

Hotels and leisure properties are leading.

Pair of conservation shophouses in Kampong Bahru Road up for sale

The property has a guide price of $18.8m.

Keppel Pacific Oak US REIT distributable income falls 12.5% to $17.47m

But its gross revenue increased by 0.2% to $49.47m.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform