Singapore tax revenue up 6.8% to $50.2b

Economic expansion triggered earnings growth and higher corporate income tax.

Singapore tax revenue jumped 6.8% YoY to $50.2b in the financial year 2017-2018, thanks to better-than-expected economic expansion in 2017, the Inland Revenue Authority of Singapore (IRAS) revealed.

IRAS attributed the increases mainly to higher Corporate Income Tax collection from improved corporate earnings and higher Stamp Duty collection due to a higher number of property transactions. The cost of tax collection remained low at 0.84 cents for every dollar collected.

The tax revenue currently represents 66.2% of the government operating revenue and 11.1% of Singapore’s GDP.

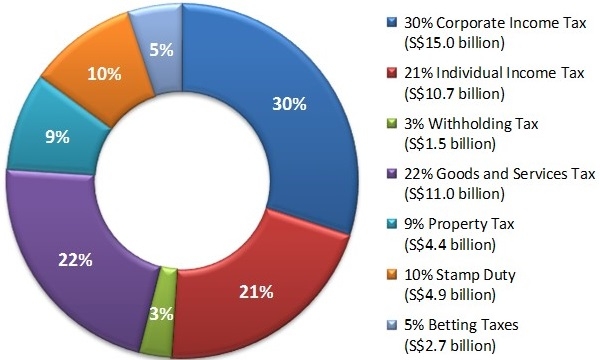

Income tax, composed of corporate income tax, individual income tax, and withholding tax made up 54% of IRAS’ collection, similar to the previous financial year. Total income taxes collected were $27.2b, 6.3% higher as compared to $25.6b last year. These were boosted by corporate income tax, which grew from $13.6b to $15b on the back of higher earnings.

GST collection stayed flat at $11b. Property tax collection also remained unchanged at $4.4b. Stamp Duty collection however soared by 49.6% to $4.9b due to a higher number of property transactions.

Betting taxes reached $2.7b, unchanged from last year. These comprise of betting duty, casino tax, and private lotteries duty.

For individual income tax, 96.5% were filed on time whilst 90.1% were paid on time. For goods and services tax (GST), 94.3% were filed on time and 89.9% were paid on time.

For payers of corporate income tax, 82.1% were filed on time whilst 84.9% were paid on time.

About 94.7% of property tax payers paid on time.

Advertise

Advertise