Finance and Markets

How Much Does a Senior Finance Manager Earn in Singapore?

How Much Does a Senior Finance Manager Earn in Singapore?

Senior Finance Manager Salary in Singapore

How Much Does a Financial Controller Earn in Singapore?

Financial Controller Salary in Singapore.

How Much Does a CFO Earn in Singapore?

How Much Does a Finance Director Earn in Singapore?

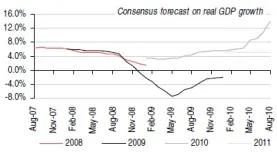

More QE means more headaches for Asia

A jump of 56.9 from 54 in the ISM Index might mean good news for the West, but does not bode well for Asia.

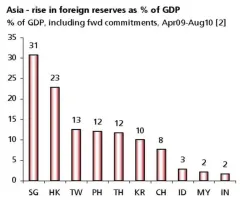

Singapore has fastest growing reserves in Asia

Singapore’s foreign reserves rose the highest in Asia over the last 12 months, expressed as 31% of its GDP.

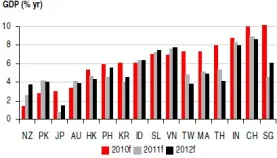

Singapore to expand the most in 2010

Although the economy is set to slow following “stunning” growth in the first half of the year, momentum is still robust says HSBC.

Electronics PMI down to 48.5

Both new order and new export orders were down in September.

Full-year GDP growth expected to hit 12.2%

Investors should stay exposed to Singapore given its decent dividend yield, reasonable earnings forecast and modest valuations, according to HSBC.

Singapore FDI rising on both approvals and actual

HSBC noted FDI actually picked up during the financial crisis as investment in the recent integrated resort developments was realised.

SGD trading near its extreme strong end

OCBC expects the pair to see a 1.3200-1.3300 range.

Prices to increase if production capacity doesn't

Industrial production output is expected to move sideways in the months ahead, with occasional swings due to the volatile pharmaceutical segment, according to DBS.

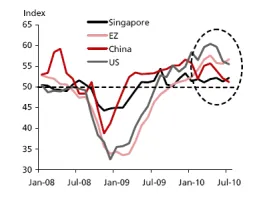

Manufacturing PMIs showing signs of slowing down

According to DBS, manufacturing PMIs in key markets are tapering off, signaling a possible slowdown in demand.

Wage inflation picks up

This is due to a tighter labour market and hikes in foreign worker levies, according to DBS.

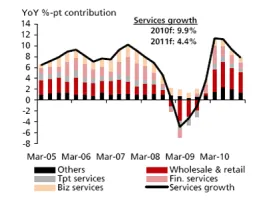

Services growth peaks

Growth was led by the wholesale and retail trade (18.9%), hotels and restaurants (10.4%) and the other services segment (12.9%), according to DBS.

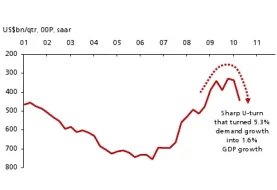

US: Decent rebound in the trade accounts expected

DBS Group Research noted if trade balance had remained stable between Q1 and Q2, GDP growth would have been 5.3% (QoQ, saar) instead of the 1.6% that it was.

USD-SGD may be further weighed by any USD-MYR heaviness

The SGD NEER is currently around +1.9% above its perceived parity and the pair is expected to be heavy but restrained within a 1.3380-1.3480 range, according to OCBC.

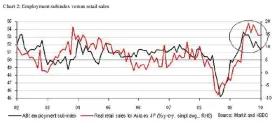

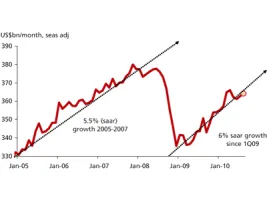

US retail sales to grow

Retail sales in the US should show a continuation of the 6% (saar) trend growth established 18 months ago, according to DBS.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform