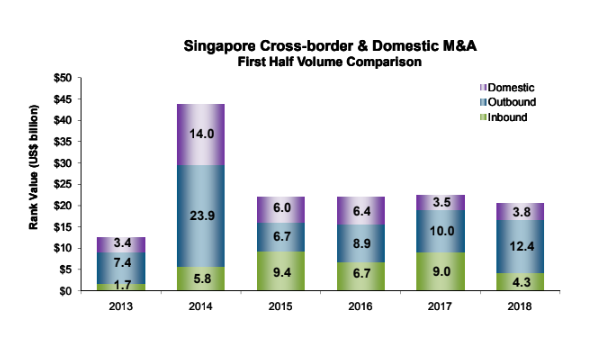

Chart of the Day: M&A targeting Singapore companies plunged to 5-year low at US$4.3b

Alibaba's purchase of shares in Lazada boosted it by US$2b.

This chart from Thomson Reuters shows that foreign acquisitions that target Singapore-based companies plummeted by 51.9% YoY to US$4.3b, marking a four-year low since 2013 (US$1.7b).

Data showed that the retail sector accounted for 46% of Singapore’s inbound M&A activity and totalled US$2b, up 99.5% from the first half of 2017. Alibaba Group Holding Ltd of China planned to raise its interest in Lazada South East Asia Pte Ltd, a Singapore-based online retailer, for a total US$2b, in a privately negotiated transaction.

It was the opposite for the M&A activity of Singapore companies targeting foreign firms. It rose 24.5% to US$12.4b in deal value, but there was a 23.2% decline in the number of announced outbound acquisitions.

Germany is the most targeted nation for Singaporean overseas deals so far this year in terms of value, accounting for 29.8% market share. Singapore’s overseas acquisitions in India reached US$1.9b so far this year, up 107% from a year ago. The United States, China, and Vietnam accounted for 13.1%, 12.1% and 10.6% market share, respectively.

Overall, Singapore's M&A activity so far hit a four-year high at US$33.8b, thanks to two large M&A deals breached the US$3b mark in H1.

Data for YTD figures were collected up until 18 June 2018.

Advertise

Advertise