Chart from LSEG

Chart from LSEG

Financials sector dominates Singapore bond offerings

The sector raised US$3.5b in 1Q24.

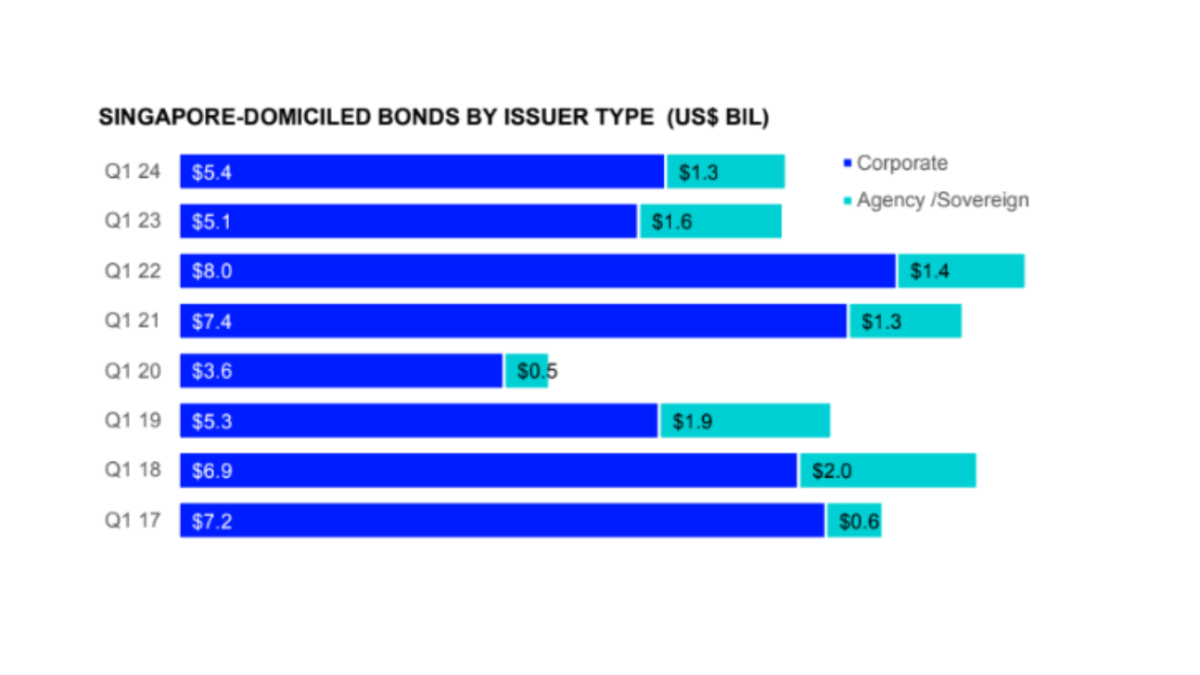

Singapore-domiciled issuers raised US$6.7b from primary bond offerings in 1Q24, translating to a 6.9% YoY decline.

The financials sector was the largest contributor to the debt capital markets in 1Q24, with US$3.5b (-28.6 % YoY) proceeds raised, capturing a 52.0% market share.

Government & Agencies followed behind, accounting for 19.9% market share, raising US$1.3b in proceeds (-16.4% YoY).

In the same quarter, the London Stock Exchange Group (LSEG) saw four green, social, sustainability & sustainability-linked bond offerings.

The ESG-related bonds raised US$1.1b, accounting for 16% of Singapore-issued bond proceeds in 1Q24.

Amongst companies, DBS Group led the Singapore-domiciled bonds underwriting league table with US$1.14m in related proceeds, capturing 16.8% market share.

Advertise

Advertise