News

Oxley sells Chevron House for $1.025b

Oxley sells Chevron House for $1.025b

The property is being revamped before the completion of the proposed sale.

Sheng Siong's profits jumped 5.9% to $19.36m in Q1

Growth was boosted by its 10 new stores.

Manulife US REIT buys US freehold Class A office building for $166.09m

The acquisition could boost the firm’s DPU by 3.3%.

Keppel Capital arm buys three Korean Grade A commercial buildings for $510m

The portfolio comprises Yeouido Finance Tower, Nonhyun Building and Naeja Building.

Daily Markets Briefing: STI up 1.49%

Expect muted gains today.

Daily Briefing: GCBI Ventures launches blockchain platform for smart cities; VC firm Big Idea Ventures closes US$50m fund

And LTA is raising the Electronic Road Pricing for motorists to $2.

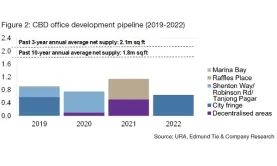

Chart of the day: CBD rents to rise up to 9% in 2019

Islandwide occupancy rate increased from 92.4% in Q4 2018 to 93.5% in Q1.

Golden Energy and Resources to launch Singapore innovation centre

It will focus on tech for mining and construction.

48,259 SMEs exited the market in 2017: study

The wholesale trade sector led cessations with 8,007 entities exiting the market.

Ascendas REIT's NPI up 3.2% to $649.58m in FY2018/2019

Its UK and Australia properties boosted income.

Frasers Logistics & Industrial Trust NPI jumped 43.3% to $45.97m in Q2

Earnings were bolstered by its 2018 and 2019 acquisitions in Europe and Australia.

IPOS cuts patenting process time for AI inventions

Application-to-grant processes will be trimmed to six months from the typical period of two years.

Quarz Capital urges merger between Ascendas Hospitality Trust and Ascott Residence Trust

The merger is said to bring an asset base and market cap exceeding $6.6b and $3.6b, respectively.

DBS removes OTPs in digital token for corporate customers

The upgraded digital token will be available in Asia starting May 2019.

UOB ties up with SGX and CCOIC to support Chinese firms

The tripartite alliance aims to help Chinese firms expand to ASEAN.

Keppel raises medium-term note programme limit to $6.81b

Proceeds will be used for corporate and working capital purposes.

DBS Q1 profit up 9% to $1.65b

Strong interest income offset declining wealth management, brokerage and investment banking fees.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform