News

Here’s why Mapletree Industrial Trust isn’t down for the count just yet

Here’s why Mapletree Industrial Trust isn’t down for the count just yet

DPUs will pick up in FY18-19, for starters.

FEHT’s income inches up 1.3% to 19.4m in Q1

Thanks to savings in expenses.

Strong sugar business to bring sweetened profit for Wilmar: analysts

The spike in sugar prices is also a plus.

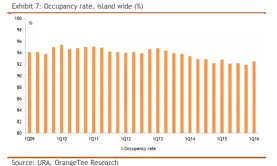

Chart of the Day: Here’s proof that occupancy rates are dipping beyond the 90% mark

It’s headed to the lowest occupancy since the 90s.

Daily Markets Briefing: STI down 0.15%

Brace for a rebound today.

Daily Briefing: More weak signs for Singapore GDP; New HDB flats now more affordable

And here’s why you should consider home loans without a lock-in period.

Singapore manufacturing output dips 0.5% in March

Though three of six clusters saw an uptick.

Singtel unveils cyber security institute to train firms against attacks

Its programs tackle threat awareness, risk management.

Online hiring for finance, accounts roles sees grows 7% in March

Despite a pullback in demand.

Is global growth on the cards for CityDev?

Its overseas exposure sits at 45% of total assets.

Great Eastern’s net profit plummets by 56% to $96.9m

Blame it on unrealised fair value losses.

Parkway Life REIT’s profits jump 8.5% to $25.1m in Q1

Thanks to bigger yields from recently acquired assets.

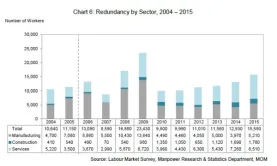

Chart of the Day: Singapore redundancies count edging close to financial crisis levels

15,580 workers were laid off last year.

Mapletree Industrial Trust’s income inches up 0.1% to $50.4m in Q4

Thanks to contribution from its new data centre.

Daily Markets Briefing: STI down 1.37%

Expect muted gains today.

Daily Briefing: Singapore bets on rising Asia middle class; Consumer prices down in record slump

And Singapore takes the smart city to a new level.

SGX teams up with China Construction Bank to attract more Chinese listings

Both direct and secondary listings are on target. The Singapore Exchange (SGX) has inked a memorandum of understanding (MOU) with China Construction Bank (CCB) to promote domestic capital markets to Chinese companies. Under the MOU, SGX and CCB will collaborate to bring Chinese companies to list in Singapore, especially through SGX’s Direct Listing Framework. CCB is among the issue managers accredited by SGX to assist companies in raising capital on the exchange. As part of the MOU, it will also advise its SGX-listed clients looking to tap the secondary market for further fund-raising. The MOU will also encourage Chinese companies to issue offshore Renminbi bonds , undertake mergers & acquisitions, establish cross-border asset management services and other capital market activities in Singapore. In addition, CCB will explore derivatives trading, bond trading and other business activities in Singapore. There are currently 120 Chinese companies and 103 RMB bonds listed on

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform