News

Chart of the Day: Condos priced below $1m dominates OCR resales in Q3

Chart of the Day: Condos priced below $1m dominates OCR resales in Q3

Buyers were able to purchase bigger units in the resale market compared to the new sale market.

China's Ant Financial eyes virtual banking licence in Singapore

It has not disclosed if it will seek a retail or wholesale licence.

ST Engineering eyes doubling smart city revenue to $1b by 2022

Its Newtec buy could give the business segment a boost.

Malaysia's new economic corridor gives tailwinds to shelved rail project

The economic corridor from Kuala Lumpur to Johor will likely run parallel to the HSR’s alignment.

Oxley cuts stake in United Engineers to less than 10%

This follows Yanlord’s acquisition of a majority stake in the firm.

MCT issues 10-year $250m fixed rate notes

It will be used for refinancing borrowings by MCT and its subsidiaries.

Ascendas property fund to raise $100m through private placement

This will fund a business park development in Bangalore.

Golden Agri-Resources sinks into the red with $12.52m loss in Q3

Plantation profits slipped due to lower fruit yield and a smaller palm inventory.

Plunge in drug exports extends NODX decline in October

Pharma drug exports plunged 36% for the month.

Soilbuild bags $162.5m contract for Tai Sheng Avenue factories

Four blocks of 8- to 9-storey factories will be built.

Banks could grapple with falling interest margins in 2020

An easing monetary policy and slow loan growth are dragging on NIMs.

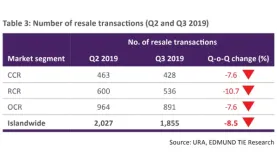

Chart of the Day: Condo resales down 8.5% to 1,855 units in Q3

This may be due to an increase in new condo launches.

Fresh floater projects to buoy Sembcorp Marine's profits

Revenue has already surged 40% to $1.04b thanks to three projects.

OCBC and Standard Chartered complete Singapore's first OIS trade using SORA

The trade is a one-year interest rate swap fixed against SORA.

S-REITs double equity offerings for 2019 with $6.1b raised so far

Ascendas REIT’s $1.3b rights issue will be the largest to date upon completion.

Property investments hit $10.2b as investors target tight office supply

The city recorded its lowest volume of office supply in a decade.

SIA passenger load factor up 2.5ppt in October

Passenger carriage grew 8.7%.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform