News

SIAS worries over Utico's last-minute changes on Hyflux deal

SIAS worries over Utico's last-minute changes on Hyflux deal

They hope that the outcome will benefit holders of the perpetual securities and preference shares.

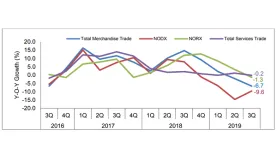

GDP to grow 0.5-1% in 2019: MTI

Manufacturing performed better than expected in Q3.

NODX decline narrows to 9.6% in Q3

It is projected to further slide between 10% to 9.5%.

Daily Briefing: Three in four students expect starting pay of over $3,000; EPS to co-launch global maritime accelerator

And Taiwan’s cloud provider CloudMile plans to enter Singapore in 2020.

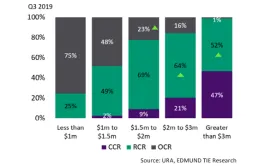

Chart of the Day: RCR takes up bigger share of sold new condos priced above $3m in Q3

The recently launched Avenue South Residence sold 26 units sized 1,000-1,500 sqft.

Daily Markets Briefing: STI down 0.28%

CapitaLand led the gains amongst top active stocks with a 0.3% climb.

Billionaires invest $46m in Australian solar farm connecting to Singapore

The 4,500km transmission network is set to be the world’s longest high voltage cable.

IHH Healthcare denies collusion with former Fortis owners

Its subsidiary only acquired shares after the exit of its erstwhile owners.

Senoko Energy denies seeking loans to weather oversupply issues

It said it has explored the possibility with EMA but currently sees no need for it.

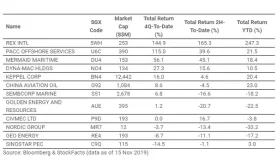

Top three oil & gas stocks averaged total return of 105.3% QTD

Rex International leads the pack with a total return of 144.9%.

Ascendas India Trust raises $150m from oversubscribed private placement

It will be used to fund a business park development in Bangalore.

Daily Briefing: Coda Payments raises $27m in funding round; Securities platform iSTOX bags $6.8m from Tokai Tokyo

And only a fifth of employees are satisfied with their health and wellness benefits.

Daily Markets Briefing: STI down 0.61%

YZJ Shipbuilding saw the sharpest decline amongst top active stocks with a 1.85% slip.

Chart of the Day: Condos priced below $1m dominates OCR resales in Q3

Buyers were able to purchase bigger units in the resale market compared to the new sale market.

China's Ant Financial eyes virtual banking licence in Singapore

It has not disclosed if it will seek a retail or wholesale licence.

ST Engineering eyes doubling smart city revenue to $1b by 2022

Its Newtec buy could give the business segment a boost.

Malaysia's new economic corridor gives tailwinds to shelved rail project

The economic corridor from Kuala Lumpur to Johor will likely run parallel to the HSR’s alignment.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform