News

Retail startup Trax buys US rewards app Shopkick

Retail startup Trax buys US rewards app Shopkick

The app lets shoppers earn rewards by browsing online offers and scanning product barcodes.

Daily Briefing: Razer to roll out Visa-issued prepaid cards; Sky Everton condo sold 40% of units in weekend launch

And higher fines for parking violators will kick into effect in July.

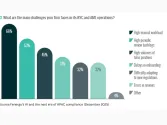

Chart of the Day: Online IT and BPO hiring surges 40% in March

The hiring spree came amidst news of a 5G rollout by 2020.

Daily Markets Briefing: STI down 0.3%

Singtel led the gains after its stock grew 0.29%.

CIMB Niaga and Liquid Group to launch cross-border QR payments between Singapore and Indonesia

Indonesian travellers will soon be able to use local payment apps at Changi airport.

StarHub moves termination of cable network to 30 September

It cited last-minute applications from customers that decided to migrate to fibre.

UOB and CapBridge to offer Asian firms access to private capital

CapBridge’s investment syndication platform will match UOB clients with anchor and accredited co-investors.

Singtel and China Literature ink digital literature deal

Singtel users can subscribe to content from China Literature’s content creation platform.

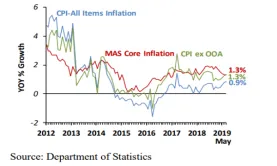

Inflation held firm at 1.3% in May

Higher retail and food inflation offset steep declines in electricity and gas costs.

YuuZoo clarifies ownership of closed Singapore office

The firm explained that YuuZoo Corporation is a different legal entity with a different board.

SGX-ST rejects International Cement's planned purchase of African firm for $141.45m

The proposed acquisition failed to meet the requirements of a VSA under rule 1015(2).

ISR Capital at risk of being placed under SGX-ST watchlist

It booked three consecutive years of pre-tax losses and six-month average daily market cap of $11m.

Straits Trading unit expands logistics footprint with Korea and Australia buys

Once fully deployed, Straits Real Estate expects a portfolio value in excess of $700m.

China business a boon for Wilmar International

It has 45% market share in consumer pack edible oils. Set for its China initial public offering (IPO) listing in Q4, Wilmar could bank on its China segment to trade at a higher valuation against its peers, thanks to its strong market positioning in the oilseeds & grains processing segment which accounted for 60% of the group’s profit after tax (PAT), according to a report by UOB Kay Hian analyst Leow Huey Chuen. The analyst noted that its ARAWANA brand is one of the well-known premium household brandsin China, not only for cooking oil but also for consumer pack rice, flour and dry noodles. “Wilmar is the top producer of consumer pack edible oils in China with about a 45% market share. Associate company, Luhua (33% stakes), is also the top peanut oil producer in China,” Leow added. With a 10% listing, the report said that proceeds from the IPO are expected to be at around $1.62b (US$1.2b) to $1.76b (US$1.3b) and the bulk of the proceeds will be utilised for expansion in China, which is in line with management’s 2019 capex guidance of $1.620-$1.76b (US$1.5b-1.6b.). “Much of the capex has been allocated for expansion of soybean crushing, wheat flour and rice milling capacities in China. Higher allocations could go towards to rice and flour, which are just starting to see consumer purchases slowly migrating to premium brand,” the analyst explained. The report also noted that Wilmar’s subsidiary, Yihai Kerry, launched a $590m (RMB3b) investment project in Guangzhou, China involving a processing complex which consists of a soybean crushing mill, consumer pack edible oil plant, specialty fats plant, rice project, chocolate project, central kitchen project, cold chain logistics project, plastic packaging materials project, consumer experience museums and other projects.

Daily Markets Briefing: STI up 0.21%

DBS led the gains after its stock grew 0.39%.

Daily Briefing: Pending Chinese and Japanese infra projects in Singapore hit US$48b; DBS poaches senior technologist from Huawei

And SingPost launched 10 new stamps to commemorate the bicentennial.

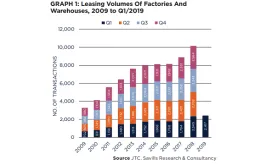

Chart of the Day: Industrial leasing volumes up for 11th straight quarter in Q1

There were 2,417 deals for factory and warehouse space during the quarter.

Advertise

Advertise

Commentary

Liquidity crucial to stock market reform

From ownership to access: Unlocking vehicle productivity in Singapore

Why Singapore schools need AI policies now: A chemistry teacher’s warning