News

Singtel and China Literature ink digital literature deal

Singtel and China Literature ink digital literature deal

Singtel users can subscribe to content from China Literature’s content creation platform.

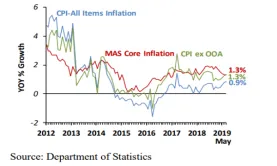

Inflation held firm at 1.3% in May

Higher retail and food inflation offset steep declines in electricity and gas costs.

YuuZoo clarifies ownership of closed Singapore office

The firm explained that YuuZoo Corporation is a different legal entity with a different board.

SGX-ST rejects International Cement's planned purchase of African firm for $141.45m

The proposed acquisition failed to meet the requirements of a VSA under rule 1015(2).

ISR Capital at risk of being placed under SGX-ST watchlist

It booked three consecutive years of pre-tax losses and six-month average daily market cap of $11m.

Straits Trading unit expands logistics footprint with Korea and Australia buys

Once fully deployed, Straits Real Estate expects a portfolio value in excess of $700m.

China business a boon for Wilmar International

It has 45% market share in consumer pack edible oils. Set for its China initial public offering (IPO) listing in Q4, Wilmar could bank on its China segment to trade at a higher valuation against its peers, thanks to its strong market positioning in the oilseeds & grains processing segment which accounted for 60% of the group’s profit after tax (PAT), according to a report by UOB Kay Hian analyst Leow Huey Chuen. The analyst noted that its ARAWANA brand is one of the well-known premium household brandsin China, not only for cooking oil but also for consumer pack rice, flour and dry noodles. “Wilmar is the top producer of consumer pack edible oils in China with about a 45% market share. Associate company, Luhua (33% stakes), is also the top peanut oil producer in China,” Leow added. With a 10% listing, the report said that proceeds from the IPO are expected to be at around $1.62b (US$1.2b) to $1.76b (US$1.3b) and the bulk of the proceeds will be utilised for expansion in China, which is in line with management’s 2019 capex guidance of $1.620-$1.76b (US$1.5b-1.6b.). “Much of the capex has been allocated for expansion of soybean crushing, wheat flour and rice milling capacities in China. Higher allocations could go towards to rice and flour, which are just starting to see consumer purchases slowly migrating to premium brand,” the analyst explained. The report also noted that Wilmar’s subsidiary, Yihai Kerry, launched a $590m (RMB3b) investment project in Guangzhou, China involving a processing complex which consists of a soybean crushing mill, consumer pack edible oil plant, specialty fats plant, rice project, chocolate project, central kitchen project, cold chain logistics project, plastic packaging materials project, consumer experience museums and other projects.

Daily Markets Briefing: STI up 0.21%

DBS led the gains after its stock grew 0.39%.

Daily Briefing: Pending Chinese and Japanese infra projects in Singapore hit US$48b; DBS poaches senior technologist from Huawei

And SingPost launched 10 new stamps to commemorate the bicentennial.

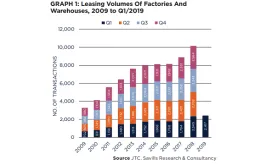

Chart of the Day: Industrial leasing volumes up for 11th straight quarter in Q1

There were 2,417 deals for factory and warehouse space during the quarter.

Sunseap secures $43m green loan from UOB

It will fund 37MWp of solar PV installations at 210 sites.

Fragrance Group to buy back up to $30m of its $100m notes

It will repurchase the notes at the daily prevailing market price quoted for the notes.

Singaporeans spend $1,086 for holiday travels on average: study

Amongst popular destinations are Malaysia, Japan, and Thailand. Singaporeans looking for an escape through leisure travel spend $1,086 on average, according to aggregator website Picodi. With only 5% saying they do not bother saving on trips, the rest applied their own strategies such as buying tickets in advance (68%) and booking their stay ahead of time (40%). The study found that Singaporeans opt for longer getaways, with 44% of them saying their trips last around a week. Meanwhile, 30% said that they spend two weeks or more on holidays, and 26% revealed that their trips last less than a week. In terms of frequency, 34% revealed that they go on holiday once a year, and 45% had the chance to go on vacation twice a year or more frequently. Meanwhile, 21% of respondents said they could catch vacation opportunities less than once a year. The study found that the most popular countries for Singaporeans as option for travel destinations are Malaysia, Japan, Thailand, Hong Kong, and Australia.

Cromwell European REIT to buy six offices for $378.18m

The properties in France and Poland have a combined LGA spanning 110,348 sqm.

Keppel Land secures $170m green loan facility

It will fund the development of Seasons City (Phase 1) in the Sino-Singapore Tianjin Eco-City.

Life insurance premiums to grow 5% in 2020

It will benefit from sustained demand for annual premium products.

Daily Briefing: Temasek unit mulls offering equity-type products for retail investors; Pavilion Energy subsidiary to buy Spanish energy firm for $176.4m

And over 75,000 e-scooters registered ahead of 30 June deadline.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform