News

SGX RegCo orders Best World's major customer to submit documents on sales and finances

The firm’s independent reviewer will now solely report to the self-regulatory organisation.

Golden Agri Resources profits climbed 53.5% to $25.07m in Q1

It was bolstered by improved performance from its palm, laurics, and other segments.

Olam's profits grew 6.9% to $168.88m in Q1

The higher contributions from edible nuts and cocoa boosted earnings.

UOL properties to get more revamps amidst Draft Master Plan's CBD agenda

It has a retail mall and three hotels in the Marina Bay area. UOL could gain from revamp and redevelopment potential riding on the government’s plan to rejuvenate the CBD, according to DBS Equity Research analysts Rachel Tan and Derek Tan. The firm has a stronghold in the area following its 50% stake acquisition in UIC and its purchase of a minority stake in Marina Centre Holdings (MCH). “UOL now has control over a prime integrated development comprising a retail mall and three hotels fronting the Marina Bay area,” the analysts said in a report.

Oxley's profits skyrocketed 121% to $67.4m in Q3

The group’s total contract value reached $3.7b.

Daily Briefing: GIC to sell stake in Acuris to ION Investment Group; Rent upswing brings cheer to residential market in Q1

And UOB snatches Deutsche Bank’s global DevOps lead for wealth management.

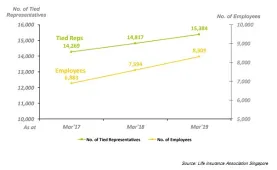

Chart of the Day: Singapore life insurance employees up to 8,300 in March

The increase coincides with premium growth.

Daily Markets Briefing: STI down 1.2%

Wall Street's weakness could weign on the local bourse today.

Middle East's Utico submits $400m binding offer to invest in Hyflux

The move comes after the private utility and developer submitted a non-binding letter of intent in May 3.

Singapore to launch corporate structure for investment funds

The move aims to encourage fund managers to set up operations in Singapore.

ThaiBev profit surges 40% to $570.3m in H1

Its food business saw the highest revenue increase to $163.3m in Q2.

UOL Group's profit fell 5% to $72.4m in Q1

The firm’s expenses more than doubled to $182.3m.

Keppel O&M arm clinches offshore wind farm contract worth over $150m

It will engineer and construct two 600MW offshore wind farm substations in Taiwan.

Wilmar International profits jumped 26.4% to $349.3m in Q1

Pre-tax profit in the tropical oils segment skyrocketed 81% to $250.88m. Wilmar International started the year with a bang as net profit climbed 26.4% YoY to $349.3m (US$257m) in Q1 driven by better results in tropical oils, sugar and consumer products. The firm noted that its tropical oils (plantation, manufacturing & merchandising) saw an 81% surge in pretax profit to $250.88m (US$183.8m) boosted by stronger sales volume and margins from the manufacturing and merchandising businesses. However, this was partially offset by lower crude palm oil (CPO) prices and production yields, which reduced the contributions from the plantation business. Meanwhile, the oilseeds & grains (manufacturing & consumer products) business saw its pretax profit almost halved (47.2%) to $124.35m (US$91.1m) from $235.59m (US$172.6m) a year ago. The segment succumbed to weaker results from the crushing business, which had been impacted by the African swine fever outbreak in China and a sharp drop in Brazilian soybean basis. For the sugar (milling, merchandising, refining and consumer products), pretax profit recovered to $2.32m (US$1.7m) from a loss of $53.23m (US$39m) a year ago, thanks to the stronger performance from refining and merchandising activities as well as the contributions from Shree Renuka Sugars Limited, in line with the ongoing sugar milling season in India. Meanwhile, the share of results from joint ventures & associates saw a 50% decrease to $28.53m (US$20.9m) as the stronger performances by the group’s Europe and Vietnam investments were offset by weaker contributions from the African associates and investments in China. Wilmar’s earnings per share jumped 28.1% to $0.56 (US$0.41) from $0.44 (US$0.32) a year ago.

Oyster Bay Fund mulls $500m investment into Hyflux

It is also looking to buy Hyflux shares for up to $26m.

Daily Briefing: Online food startup Grain raises $10m in series B funding; Woodleigh Residences launched sale for a minimum of $1,733 per sqft

And check out which Singapore-based REITs is the cheapest.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform

From ownership to access: Unlocking vehicle productivity in Singapore