News

Daily Briefing: GIC to buy US$70m of shares from pharma firm Hansoh; NWC proposes $50-$70 pay hike for low-wage workers

And CapitaLand plans to achieve 100% green certification by 2030.

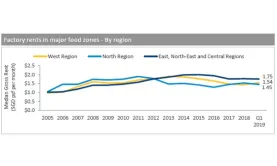

Chart of the Day: Check out how food factory rents can cost

Factories with freezer and refrigerated facilities can fetch 25-35% higher price than the average.

Dairy Farm could rely on health and beauty segment to drive earnings

Its food division is floundering whilst its supermarkets suffer from poor locations and lack of improvement programmes.

Hotel demand to continue outstripping room stock in 2019

Visitors who cannot find rooms are forced to turn to alternative accommodation providers.

Funan could bring in $16.5m of rental income to CapitaLand Mall Trust

Its retail segment and office segment are already pre-committed by 90% and 98%, respectively. CapitaLand Mall Trust could finally reap the benefits from its new mall Funan by H2 2019, according to UOBKH analyst Jonathan Koh and Peihao Loke. The mall’s retail net lettable area (NLA) is about 325,000 sqft, of which 90% is already pre-committed, the report noted. Funan also has two grade-A office blocks with NLA of 214,000 sqft that are 98% pre-committed, with key tenants including government agencies Attorney General’s Chambers, the Department of Statistics, and Smart Nation & Digital Government Office, as well as coworking operator WeWork. “Management expects Funan to provide yield-on-cost of 5%. We estimate Funan to contribute rental income of S$16.5m in 3Q19, representing 8% of total gross revenue,” the analysts said. Also read: Should incumbent malls be threatened by Jewel Changi and Funan in 2019? The report also noted that the retail mall is designed to integrate online and offline shopping with data analytics and logistic functions to empower modern retailers’ omni-channel strategy. “It has a 24-hour click-and-collect drive-through supported by warehousing facilities. It deploys automated guided vehicles (AGVs) with laser-based navigation system to pick up purchases from retail shops for temporary storage at click-and-collect boxes (shoppers do not have to carry shopping bags),” they explained. Funan is scheduled to open in June 2019. It is by far 85% larger than its predecessor Funan DigitaLife Mall, which closed on July 2016.

GoJek hits 10 million Singapore trips 6 months after kickoff

It will launch a rewards programme for drivers who have completed over 1,000 trips since November. Indonesian ride-hailing platform GoJek hit the milestone of 10 million completed trips in Singapore after six months of operations in the city-state, according to an announcement.

LTA initiatives a boon for ComfortDelGro

A proposal for a new rail line could fuel a contract win for SBS transit.

Hyflux gets another debt moratorium extension to 2 August

It has yet to accept and enter into binding agreements with potential investors.

Daily Markets Briefing: STI down 0.06%

Don’t expect gains today.

Chart of the Day: Resale condo prices rose 0.2% in April

The 1.4% price growth in the central region countered the decline in the non-central region.

Daily Briefing: MAS denies US' currency manipulation claims; Cascadale condominium for sale at $270m

And G&G Group and the Sri Lanka-based EMS jointly acquire a tea plantation firm.

81% of employees saw wage hikes in 2018: study

Total wages in the private sector grew 4.6%.

No binding agreement with Utico yet: Hyflux

The move comes after the UAE-based firm offered a part cash redemption to its retail investors.

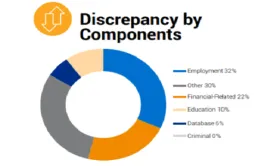

One in three employees lie about their work history: report

The number of employment background checks has dipped 4% since 2016.

Over three-fourths of firms fall prey to financial crime: study

Companies now plan to spend on average 46% more to adopt technologies to counter it.

MAS re-appoints three officials to board

Ravi Menon will be a board member and MAS managing director for two years.

Advertise

Advertise

Commentary

Why Singapore businesses must focus on outvaluing, not just upskilling

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform