News

Singapore is the fifth most property-obsessed nation

Residents spend around 3.2 hours researching possible property buys.

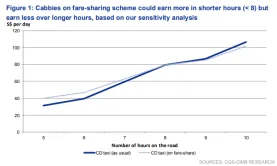

ComfortDelGro could lure in cabbies with new profit-sharing scheme

The scheme cuts taxi rental rates from $105 to $68-78 a day in exchange for 15% of cabbies’ fare takings.

Keppel looks to raise $500m via two note issues

The notes are expected to be issued on 7 May on the SGX-ST.

Ascott REIT profits leapt 12% to $54.62m in Q1

Its properties in Singapore, UK and Philippines drove up earnings.

Surbana Jurong and Silk Road Fund to co-invest US$500m in Southeast Asia infrastructure fund

The fund will focus on greenfield projects in the region.

Amber Park could launch sales on 4 May

The developer opened previews for the 592-unit development on the weekend.

CapitaLand launches $5b euro medium term note programme

Proceeds from the notes will refinance existing debt.

Oxley sells Chevron House for $1.025b

The property is being revamped before the completion of the proposed sale.

Sheng Siong's profits jumped 5.9% to $19.36m in Q1

Growth was boosted by its 10 new stores.

Manulife US REIT buys US freehold Class A office building for $166.09m

The acquisition could boost the firm’s DPU by 3.3%.

Keppel Capital arm buys three Korean Grade A commercial buildings for $510m

The portfolio comprises Yeouido Finance Tower, Nonhyun Building and Naeja Building.

Daily Markets Briefing: STI up 1.49%

Expect muted gains today.

Daily Briefing: GCBI Ventures launches blockchain platform for smart cities; VC firm Big Idea Ventures closes US$50m fund

And LTA is raising the Electronic Road Pricing for motorists to $2.

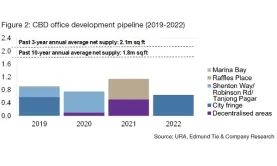

Chart of the day: CBD rents to rise up to 9% in 2019

Islandwide occupancy rate increased from 92.4% in Q4 2018 to 93.5% in Q1.

Golden Energy and Resources to launch Singapore innovation centre

It will focus on tech for mining and construction.

48,259 SMEs exited the market in 2017: study

The wholesale trade sector led cessations with 8,007 entities exiting the market.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform