Share buyback consideration hits $70.1m in August

23 SGX-listed stocks bought back 71.5 million shares.

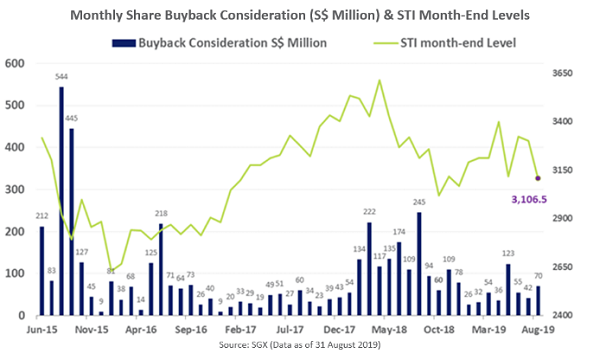

Total share buyback consideration rose to $70.1m in August from $41.6m in July, exceeding the average monthly consideration of $57m over the past six months, according to an SGX report.

A total of 23 SGX-listed stocks have reported buybacks over the month, buying back 71.5 million shares or units.

However, SGX noted that the monthly figure is less than the $245m buyback consideration filed in August 2018, when the STI also declined on trade tensions.

Yangzijiang Shipbuilding has led total buyback consideration in August as it bought 20 million shares for $18.47m, followed by DBS Group at $13.26m and ST Engineering at $8.79m.

The Straits Times Index (STI) also dipped 5.9% in August, with dividends marginally improving the total return to a decline of 5%. This brought the STI’s total return for the first eight months of 2019 to 4.8%, whilst the FTSE ST Mid Cap Index doubled the STI’s gains with a 9.8% total return.

This is also said to be in-line with the Hang Seng Index declining 5.9% in total return and the FTSE ASEAN All-share Index which also fell 2.4% in total return.

Advertise

Advertise