News

Cost cutting is no longer an option for struggling ST Engineering, say analysts

Cost cutting is no longer an option for struggling ST Engineering, say analysts

It needs all resources to support its electronics segment.

Suntec City Mall makeover fails to work wonders for Suntec REIT

Final rents failed to meet targets.

This is the biggest threat against Singapore’s robust construction sector

The slowing property market is a key drag.

Condo resale volume jumps by 10% in October

505 units were resold this month.

The SGD is waging a losing battle over the strong greenback

The currency will head lower in 2016.

Is the worst over for StarHub’s broadband?

The telco’s broadband business has seen better days.

Weaker ringgit sharpens Venture’s competitive edge, analysts say

It’s luring more businesses into its bandwagon.

Daily Markets Briefing: STI down 0.4%

Expect a pullback today.

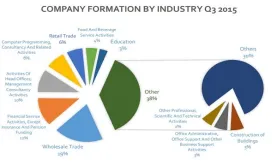

Chart of the Day: Wholesale trade sector grabs lion’s share of business formations in Q3

Singapore’s strategic location continues to cultivate trading.

Daily Briefing: Asia’s debt threat; Climate change could force Singaporeans underwater

And tech companies dominate best places to work in Singapore.

SGX’s largest F&B stocks spiked 12% in October

They’re making a comeback after crashing in September.

Singtel bags Barclays Premier League broadcast rights for three more seasons

It starts on August 2016.

Mammoth CapitaLand shrugs off hefty extension charges for unsold units

It forked out $3.5m in Q3.

Eligible Singaporeans have until end-2015 to apply for GST Voucher, Medisave top-up: MOF

Almost $1b in benefits have been disbursed.

SIA unveils high-speed WiFi for long-haul flights

Data speeds could reach 50Mbps.

Here are the key takeaways from the Singapore-China financial cooperation meeting

China’s eager to tap on Singapore’s investor base.

REITs roll out desperate tactics to drive growth in tough times

Check out these interesting trends seen in Q3.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform