Sembmarine banks on more orders to bounce back into the black

Sembmarine's strong order pipeline could translate to $3b or more in new orders in 2019.

Despite a weak start to the year, a recovery may be in the works for Sembcorp Marine who is hoping to lure more orders in the rest of the year.

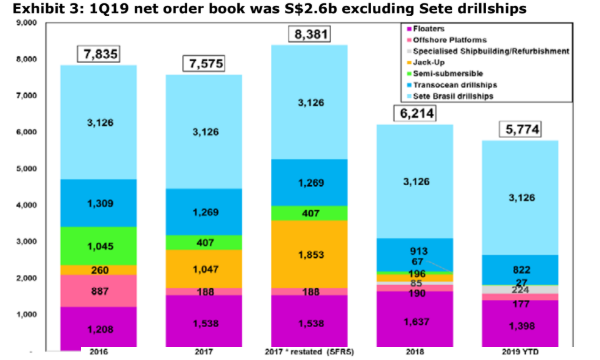

New contracts secured in Q1 hit $175m which include the design and construction of a 12,000-cbm LNG bunker vessel and repair works for 13 cruise ships and a net order book (excluding the Sete drillship contracts) stood at $2.6b which represents around half of total FY18 revenue, data from OCBC Investment Research (OIR) show.

“SMM has to be selective when securing new orders (e.g. those with not too unfavourable payment terms), considering the group’s current balance sheet position and that future new orders may have increased working capital needs,” Pei Han Low, analyst at OIR, said in a report.

Order book also declined to $5.77b as at end-March, from $6.21b a quarter ago, out of which c.54% or $3.1b is from drillship projects with Sete Brasil, according to DBS Equity Research.

Also read: Sembmarine Q1 profit plunges 67.8% to $1.7m

A turnaround, however, may be in sight as Sembmarine banks on new orders and contracts to bounce back into the black. Offshore and marine sector continues to improve and the offshore drilling activities saw an increase in utilisation and day rates. “Whilst YTD contract wins are lagging, management is seeing higher enquiry level and tendering, which would translate into higher contract wins, and thus benefit both the top line and bottom line,” DBS Equity Research analyst Pei Hwa Ho said.

Based on existing capacity, Ho estimates that Sembmarine requires around $4-5b worth of order replenishments every year in an ideal case.

“We believe SMM’s strong order pipeline would translate into $3b or more in new orders in 2019, which may include, 1) a Gravifloat modularised liquefied natural gas (LNG) exporting terminal for Poly-GCL at c.S$1bn; 2) two large Compressed Gas Liquid carriers for SeaOne Caribbean valued at $800m in total, 3) Rosebank’s floating production storage and offloading (FPSO) contract that could be worth up to US$2b,” she added.

Sembmarine’s Q1 profit crashed 67.8% YoY to $1.7m from $5.3m in 2018, mainly due to a continued low overall business volume which impacted the absorption of overhead costs, offset by margin recognition from newly secured production floater projects and delivery of rig.

Advertise

Advertise