Singapore faces a credit meltdown

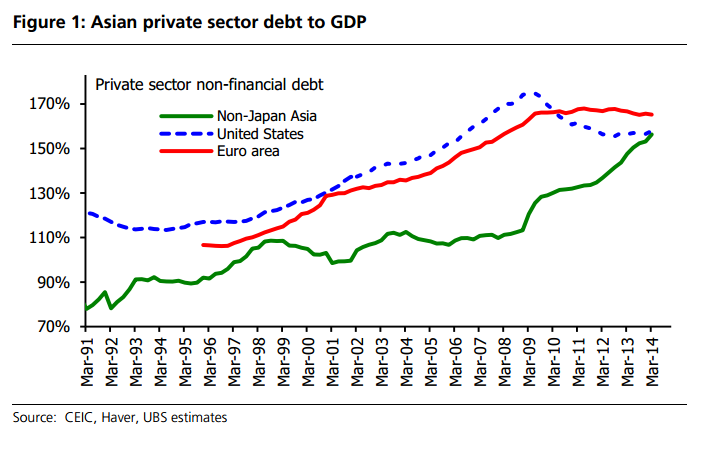

Debt levels higher than the US pre financial crisis.

Singapore and other Asian countries could be facing an economic crisis of the same type as the US financial meltdown that put the world’s economies to its knees. Singapore and many Southeast Asian countries have already surpassed US debt-to-GDP ratio. There is no sign of that debt growth slowing down. This is eerily similar to the financial conditions that pre-dated the American collapse, and economists are deeply concerned.

According to Duncan Woolridge of UBS, “China, North Asia, Hong Kong, Singapore, Thailand, and Malaysia stand out based on levels of leverage alone as at risk. This trend appears unsustainable and a reversal on the horizon should be expected, though we do not claim to know the exact day that will unfold.”

Here’s more:

Liquidity risk matters as much as leverage. UBS expects the Fed to hike 25bps in mid-2015 and raise Fed Funds to 1.25% by end 2015.

Countries with current account deficits, high loan to deposit ratios, or completely open capital accounts should find it difficult to grow deposits fast enough to sustain the current pace of credit growth, in our view.

Aggressive reform is urgently needed, in our view, unless exports can bail out the region. Unit labor costs (ULCs) have been rising because of weak exports, which is mainly a function of weak DM economic growth.

Asian policies generally aim to prevent unemployment from rising and to sustain wage growth when exports slow. They have largely succeeded at this, but the result is rising ULCs and that means real effective exchange rates appreciate.

That's ok as long as DM demand recovers soon, exports return to strong growth, and ULCs stabilize. However, we still think that export growth on a volume basis will remain perhaps 40-50% below pre-crisis even assuming better exports to DM going forward.

This means no relief for ULCs and real exchange rates should appreciate, but of course they cannot appreciate ad nauseam without a loss of competitiveness and trade deficits.

Advertise

Advertise