Property investments fell 37% to $3.02b in Q1

Big-ticket commercial deals were absent due to weaker market sentiment.

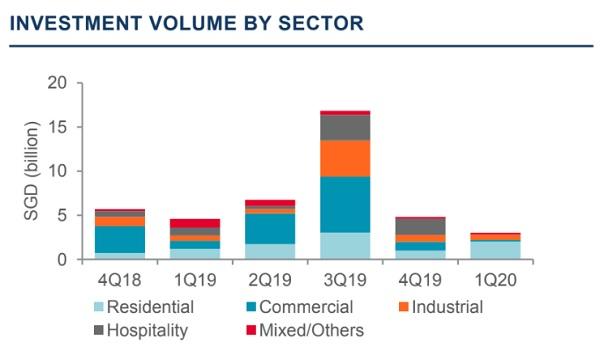

Property investment volume crashed 37% QoQ to $3.02b in Q1 2020, according to a report by Cushman & Wakefield. The hard-hit hospitality sector clocked no deals at all, as travel bans and lockdowns led to a significant drop in investor enthusiasm for such assets.

However, this was countered by residential deals, which surged two-fold to $2.02b. This was mainly attributed to the awarding of numerous residential government land sales (GLS) sites. The public sector now accounts for 68% of the total residential volume.

Meanwhile, the commercial sector recorded an 81% plunge in transactions at $184m, whilst industrial sector deals fell 22% to $606.8m. Big ticket commercial transactions were absent due to weaker market sentiment from the pandemic and the rapid sell-off in stock markets across the globe.

The report noted that sellers are unwilling to cut prices, hoping that the economic downturn would be temporary. Meanwhile, buyers are on a wait-and-see approach, being cautious to enter at more attractive prices, as the reality of a global recession amidst lockdowns becomes likely.

Nevertheless, the quarter still recorded strata deals of palatable quantum. A South Korean high net worth individual acquired the 11th floor of Samsung Hub from Sun Venture for as high as $49.8m. This $3,800 psf achieved topped the previous high of $3,550 psf in 2018.

In tandem with the peaking of office rents, the Grade A CBD office capital value dipped to $2,920 psf, whilst yields held steady at 3.2%. The Federal Reserve slashed its benchmark interest rate to zero, but office yields may not see further reductions due to weaker investor demand.

The muted tone in the investment market is expected to continue, as investment activity in Q2 will take a hit from the lockdown on non-essential services in April. With a looming global recession, the investment volume in Singapore is projected to tumble to $10-$15b in 2020.

“On a more optimistic note, the decline in interest rates could lead to a rapid return of investment activity in 2021 once investor sentiment recovers after the pandemic is contained,” the report noted.

Advertise

Advertise