In Focus

Hormuz crisis forces transport firms into costly airspace rerouting

Hormuz crisis forces transport firms into costly airspace rerouting

Shipping disruptions are forcing high-value time-sensitive cargo from sea to air to support SATS volumes.

31 minutes ago

Business sentiment breaks six-month downward trend in Q4 2025

IT and Banking sectors are surging with confidence, whilst Retail and Hotels remain in the "challenged" zone.

1 hour ago

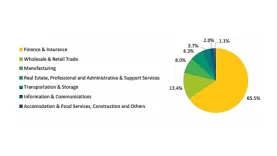

Finance and insurance industry claims 65.5% of FDI stock

The wholesale and retail trade sector follows with 13.4%.

1 hour ago

MAS targets more IPOs via Global Listing Board

A clearer pathway for dual listings could boost the city-state’s appeal.

1 day ago

Analysts hold 2026 growth view after 16.6% surge

Output increased 5.3% MoM in January.

1 day ago

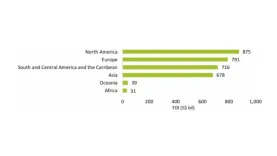

North America supplies 27.9% of Singapore FDI

Europe follows with $791b share.

1 day ago

SGX reforms set stage for 20+ IPOs in 2026

2025 logged 13 listings raising over $2.5b, Deloitte said.

4 days ago

Agile hiring beats permanent roles on shift to project-based AI teams

Permanent hiring has stabilised but remains largely replacement-led.

4 days ago

Singapore corporate FDI stock topped $3.13t in 2024

Foreign investment rose 9.5% in 2024, marking steady five-year growth.

4 days ago

Fee income cushions banks amidst NIM squeeze

Singapore’s top banks saw NIMs dip 12 to 29 basis points YoY.

5 days ago

AI skillsets ranked No. 1 hardest to find

Seven in 10 employers said hiring skilled workers has become a struggle.

5 days ago

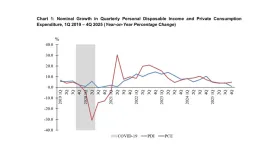

Singaporean savings slump 5.1% as consumption outpaces pay

Households hit a 36.4% personal saving rate despite the overall quarterly contraction.

5 days ago

Trade-related sectors may slow as 2026 growth moderates

Manufacturing and trade activity were key drivers of the recent 5.3% and 5% expansions.

6 days ago

High-income workers delay retirement as 45% cite 'sandwich generation' strain

Eight in 10 expect to fund relatives even after leaving the workforce.

6 days ago

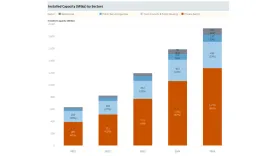

Private sector dominates 66% of grid solar capacity

Private installations reached 1,273 MWp in Q3 2025.

6 days ago

Leaner menus seen as key after 2,431 F&B outlets shut

Closures have reached a near 20-year high following a wave of business liquidations.

Singapore strengthens digital infra with 10Gbps rollout and quantum-safe network

It is taking its digital lead to the next level, targeting 500,000 homes for 10Gbps broadband by 2028.

Advertise

Advertise

Commentary

Why phishing and software updates still matter for Singapore organisations

Why Singapore businesses must focus on outvaluing, not just upskilling

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform