Is bigger always better? OUE's mega-merger fails to soothe investor jitters

Investors usually opt for a REIT purely focused on a particular sub-asset class.

The proposed merger of OUE Commercial Trust (OUECT) and OUE Hospitality Trust (OUEHT) into a $6.8b entity does not necessarily entail that bigger is better.

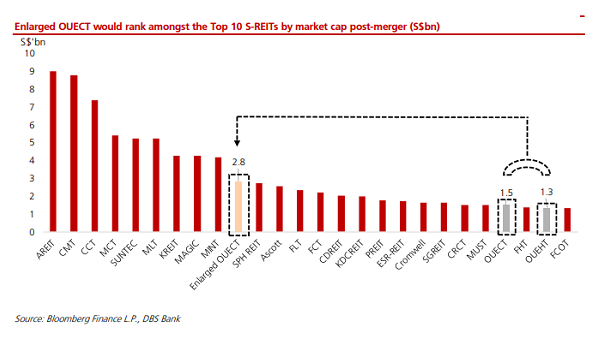

OUECT earlier offered to buy OUEHT via a cash and stock deal that will create an entity with a market cap of $2.9b, the 10th largest in Singapore from 22nd and 24th respectively. The combined trust would generate around $287m in net property income (NPI) from 60% of office assets and 40% from hospitality assets.

Post-merger liquidity will also push OUECT free-float from $0.4b to $1.1b, which will make it the 17th most liquid REIT in Singapore, according to Mervin Song, an analyst at DBS, enabling the company to catch up to bigger players such as CapitaLand-managed REITs, Mapletree Group of REITs, A-REIT, Keppel REIT and Suntec REIT. OUEHT‘s free-float will likewise increase to $1.1b from $0.7b previously.

Despite the myriad benefits of the deal, the merger of OUECT-HT will mark the first REIT with a mixture of office and hotel assets where approximately 75% will be office/retail and the remaining 25% will be hotels. This entails a largely uncharted territory for investors that typically prefer a REIT purely focused on a particular sub-asset class.

“Whilst a larger market cap may result in OUECT being added to major stock or property indices translating to greater investor interest, this may not necessarily result in an immediate compression in yields given increased complexity arising from having both office and hotel assets,” said Song.

The only exception which the market has largely accepted has been a mix of office and retail assets such as MCT, MAGIC, Suntec and SGREIT.

Moreover, the firm’s share price has yet to recover as the planned merger comes on the heels of OUECT’s rights issue in late 2018 to acquire OUE Downtown Oakwood serviced apartments. “[W]e believe there may be some push-back from some investors, especially given the relatively long wait until August when the merger is scheduled to be completed and the overhang from the issuance of more units to fund the acquisition of OUEH,” Song said.

“In addition, the yet-to-be exercised convertible perpetual preferred units (CPPUs) held by the sponsor and potential injection of OUE Bayfront Oakwood serviced residences, which at this point is unlikely to be accretive, remains an overhang which the merger has not fully resolved,” he added.

Post-merger gearing would also hover around 40% which raises the possibility of impeding investors to cap share price performance.

If investors, however, are convinced about the merits of the merger, OUECT-HT could gain inclusion to various indexes by being exposed to a wider pool of institutional investors and potentially greater broker coverage which could unlock a positive cycle that could result in a lower cost of capital over time.

Advertise

Advertise