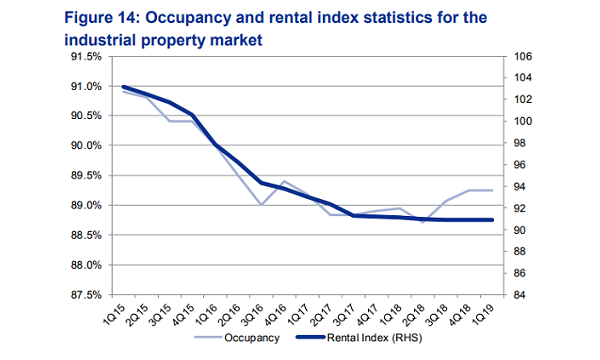

Chart of the Day: Industrial occupancy rates up 0.3ppt in Q1

This lifted industrial REITs' results in Q1.

This chart from CGS-CIMB shows the 0.3 ppt YoY increase in the occupancy rates and the rental index of the overall industrial property market. According to CGS-CIMB analyst Lock Mun Yee, this supported industrial REITs' encouraging results in Q1 2019.

Industrial REIT results in Q2 could be driven inorganically YoY such as commencement of Mapletree Industrial Trust's 18 Tai Seng, however, operational metrics are likely to continue to be flattish, according to the analyst.

Also read: Mapletree Industrial Trust to buy 18 Tai Seng property for $262.2m

"The bifurcation of demand between higher and lower specification assets could continue, especially for logistics assets, due to automation and e-commerce requirements," she said.

Moreover, whilst the trade war has not had a significant impact on industrial REITs, corporates appear to have become more cautious in tenancy decisions. "We think long drawn tensions could potentially negatively impact the whole industry. Whilst Hyflux and CWT headlined tenant default risk in Q2, they continue to be current with rents," she said.

On 6 March, ESR-REIT filed proofs of claim against Hyflux. 100% of its 8 Tuas South Lane property is leased to Hyflux with the water treatment firm currently on the first year of its 15-year lease with ESR-REIT.

Meanwhile, HNA’s CWT International, the parent of CWT Limited, failed to pay interest, triggering a cross-default to lenders under a HK$1.4b facility agreement.

Advertise

Advertise