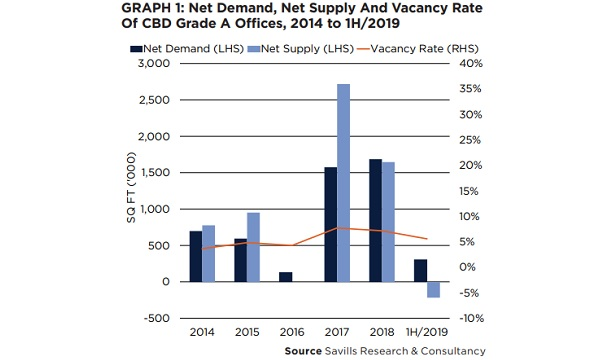

Chart of the Day: Vacancy rate of CBD grade A office space fell to 5.6% in Q2

Demand hit 376,000 sqft even if there were no new completions of office space in Q2.

This chart from Savills shows that the vacancy rate of CBD grade A office space continued to slip 1.2% QoQ to 5.6% in Q2 from 6.9% in Q1.

Overall, vacant stock in the period is about 1.8 million sqft. Vacancy rates in the other micro-markets, including Tanjong Pagar, City Hall and Beach Road, recorded marginal declines between 0.1 and 0.9 of a ppt from the previous quarter. Tanjong Pagar area saw a 3.6 ppts rise in Q1; Beach Road/Middle Road inched up 0.2%; whilst City Hall had a 0.1ppt decline last quarter.

Meanwhile Raffles Place’s vacancy rate stayed at 3% for the second consecutive quarter. In contrast, the Orchard Road micro-market’s vacancy rate experienced a modest QoQ increase of 0.5 ppt.

There were no new completions of CBD grade A office space in Q2, whilst net demand was about 376,000 sqft during the same period.

Savills added that slowing demand for traditional offices, coupled with tenants’ increasing resistance to rent hikes upon lease renewal, has begun to shift the balance of negotiating power away from landlords. Consequently, they have lowered their asking rents in recent months.

Advertise

Advertise