Far East H-Trust NPI up 30.7% to $49m in H1, RevPAR at S$133

Distribution per stapled security or DPS is 1.92 cents for the period

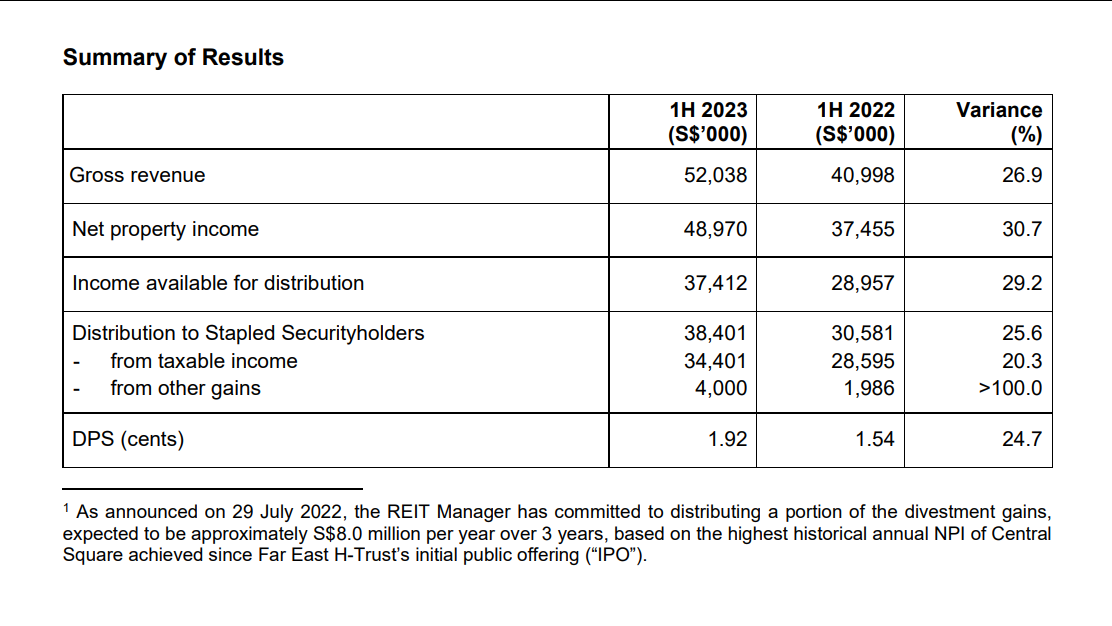

Far East Hospitality Trust (Far East H-Trust) saw its income available for distribution rise to S$37.4m in the first six months of 2023, a 29.2% growth compared to the same period last year.

Net property income (NPI) grew 30.7% to S$49m on the back of higher revenue and lower property expenses, Far East H-Trust said in an SGX filing.

Thanks to the higher NPI, distribution to stapled security holders grew 25.6% to S$38.4m.This translates to a DPS of 1.92 cents, a 24.7% increase compared to H1 2022.

The average daily rate (ADR) of Far East H-Trust’s hotels jumped 71.4% to S$169, breaching the hundred dollar mark compared to last year’s S$99. This was driven by demand from corporate groups and further recovery of leisure bookings.

Revenue per available room (RevPAR) almost doubled, growing 96.9% to S$133.

The hotels on government contracts were also contracted at higher rates than in H1.

Average occupancy of hotels increased 10.1 percentage points to 78.3%, with some hotels ramping up operations as it exited its government contracts. Notably, Far East H-Trust’s The Elizabeth Hotel–rebranded as Vibe Hotel Singapore Orchard– was closed for renovation in H1 2022 but operational in 2023.

Serviced residences continued to demonstrate strong performance with new long-stay bookings secured at higher rates, Far East H-Trust said. As result, ADR for SRs grew 23% year-on-year (YoY) to S$253, whilst RevPAU registered a 22.8% YoY increase to S$224, close to the all-time high of S$230.

Revenue from Far East H-Trust’s retail and office spaces also recorded an 11% groweth to S$8m, despite the trust’s disposal of Central Square.

Higher occupancies and rents were secured on the back of the improving market, Far East H-Trust said in its bourse filing.

Revenue of the existing commercial spaces notably grew by 20.4% YoY during the period.

Far East H-Trust also received an additional payment of S$18m from the acquirer of Central Square, after obtaining provisional permission from the Urban Redevelopment Authority of Singapore.

Looking forward, the REIT expects further rebound in Singapore’s hospitality sector.

“With further restoration in flight capacity of major carriers in Asia Pacific and recovery of visitor arrivals into Singapore, supported by a healthy pipeline of events and activities, the portfolio can be expected to benefit from the rebound in the local hospitality sector,” said Gerald Lee, CEO of Far East H-Trust.

Advertise

Advertise