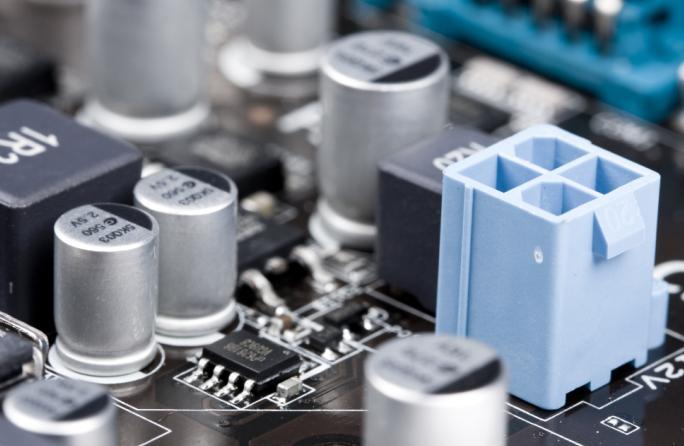

Electronics exports down 15.2% in May

Blame it on fewer shipments of integrated circuits, PC components and disk drives.

OCBC Investment Research said, “The disaster in Japan could also have been another probable cause to the lower electronics export numbers due to the shortage of components.”

In terms of the semiconductor sector, OCBC Investment Research noted:

| 1QCY11 marred by cost pressures. The recent 1QCY11 results released by most semiconductor companies listed on SGX exhibited a common trend - rising cost pressures which have caused margins and hence profitability to decline. Such cost pressures have arisen from increasing raw material prices & labour costs (due largely to the minimum wage policy implemented by the PRC government), unfavourable currency movements and higher energy prices. Of the ten Singapore-listed companies we have tracked, seven of them delivered revenue growth although only four reported an improvement in net profit, attributed mainly to the aforementioned factors. Despite such discouraging statistics, we are maintaining our BUY rating and S$0.67 fair value on Micro-Mechanics Holdings (MMH). In our opinion, MMH was one of the few bright sparks in the semiconductor industry in the previous quarter, having reported a healthy 31.6% YoY bottom-line growth. We continue to like MMH for its attractive prospective dividend yield of 6.6% and potential upside ahead. Global chip sales in Apr show YoY growth... Latest data from the Semiconductor Industry Association (SIA) indicated that global semiconductor sales for Apr 2011 increased by 3.9% YoY to US$24.7b, although this represented a 2.2% sequential decline. We note that this YoY increase was the 18th straight month of YoY growth since Nov 2009, notwithstanding the apparent slowdown in growth magnitude. The sequential decline in semiconductor sales could partly be attributed to the recent Japanese earthquake and tsunami, which had resulted in supply chain disruption. However, efforts are ongoing to remedy the production process and thus SIA believes that significant improvement should be reflected in 2H11. …although Singapore's May electronics exports disappoint. Singapore recorded a 15.2% YoY fall in electronics exports in May, which was the fourth consecutive monthly YoY decline. This was attributed largely to fewer shipments of integrated circuits, PC components and disk drives. The disaster in Japan could also have been another probable cause to the lower electronics export numbers due to the shortage of components. Maintain NEUTRAL. In addition, IMF recently pared its forecast for U.S.'s GDP growth to 2.5% and 2.7% in 2011 and 2012 respectively (previously 2.8% and 2.9%). Given the openness of the Singapore economy and the importance of U.S. as a key export market, we opine that semiconductor companies could thus be adversely affected. Nevertheless, we see potential for growth ahead, albeit at a more moderated pace vis-a-vis 2010, given the still popular demand for IT gadgets such as smartphones and tablets and the increasing prevalent use of semiconductors across various industries. Hence we maintain NEUTRAL on the sector. |

Advertise

Advertise