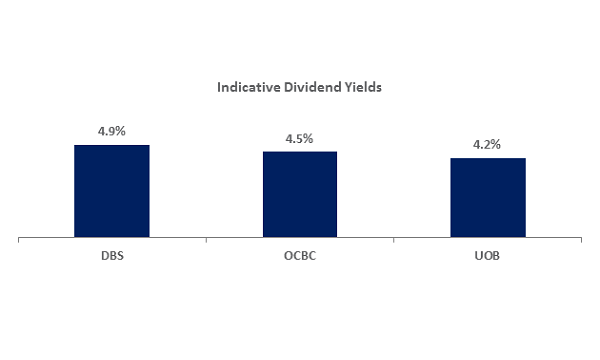

Big banks hit average dividend yield of 4.5% in H1

DBS led the pack with a dividend yield of 4.9%.

DBS Group (DBS), Oversea-Chinese Banking Corp (OCBC) and United Overseas Bank (UOB) have maintained an average indicative dividend yield of 4.5% in H1 as the Big Three continues to enjoy strong profit growth, according to an SGX report.

Also read: Singapore banks' dividend yields tower over ASEAN peers at 5.1% in 2019

Since the end of October 2018, the average indicative dividend yield of the three banks at the end of each month has remained above 4.0%. DBS has the highest dividend yield at 4.9% in H1, whilst OCBC and UOB were at 4.5% and 4.2%, respectively.

The three lenders also rank amongst the ten largest weights of a number of indices, including the Straits Times Index (STI), FTSE ASEAN All-Share Index and FTSE Developed Asia Pacific ex-Japan Sustainable Yield Index.

DBS maintains the fifth largest weight within the FTSE Developed Asia Pacific ex-Japan Sustainable Yield Index, with OCBC claiming the sixth largest weight and UOB the tenth largest weight. Together, the three banks maintained as much as 8.7% of the index weight as of July 31.

The three banks maintain a combined market capitalisation of $151b with an average daily turnover of $230m over the first seven months of 2019. Their average total return is at 10% over the same period.

In the first half of the year, DBS, OCBC and UOB reported an average 9% YoY increase in net profit. Combined, the three banks registered total income of $17.5b, up from $15.9b in H1 2018. The average net interest margin (NIM) for the three banks in H1 was 1.82%, compared to 1.78% in H1 2018.

Also read: Banks' NIM expansion could hit 1-2bp in Q2

The average return on equity (ROE) for the three banks stood at 12.5% for the same period, up from 12.1% in H1 2018 and its average price-to-book (P/B) of the three banks is currently 1.1x, which ranges from 1.0x for OCBC to 1.3x for DBS. By comparison, the five-year average P/B for the three banks is 1.2x.

DBS, OCBC and UOB also averaged intraday 1 minute annualised volatility of 12.4% over the first seven months of 2019, compared to an average of 18.2% for the remaining STI stocks.

Advertise

Advertise