Chart of the Day: Can Singapore banks handle credit growth in 2018?

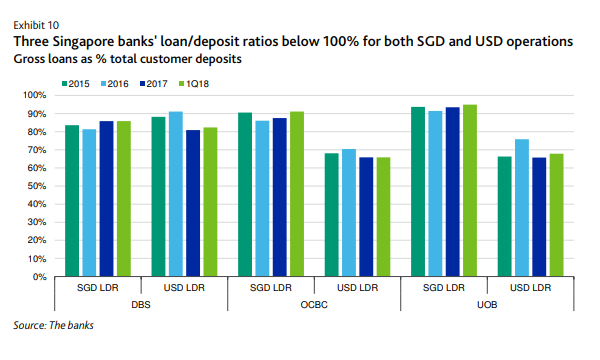

Loan/deposit ratios remained below 100%, allowing the banks to accommodate credit growth.

This chart from Moody's Investors Service shows that for DBS, OCBC, and UOB, loan/deposit ratios remain comfortably below 100% for both the Singaporean and the US dollar.

"This provides them with a sufficient liquidity buffer to accommodate our credit growth assumption of 7%-8% in 2018," said Moody's Investors Service vice president-senior analyst Simon Chen.

Banks also reported net stable funding ratios (NSFR) that were comfortably above the 100% minimum that domestic systemically important banks need to comply with from 1 January 2018 onward.

Moreover, the banks' profitability is expected to improve not only due to wider margins but also credit costs as low provisions will further contribute to net profit.

Advertise

Advertise