Chart of the Day: Singapore banks at risk from shaky foreign loans

Southeast Asian corporates are a sore spot.

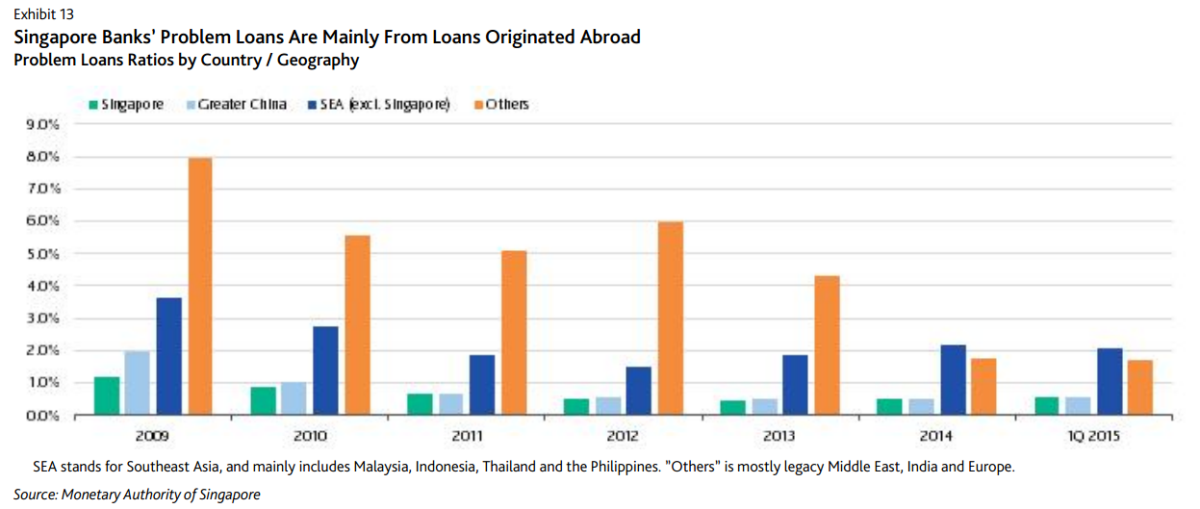

Singapore banks will see a mild deterioration in asset quality due to non-performing foreign loans, according to a report by Moody's.

Moody's said that loans to corporates in emerging markets will likely deteriorate in the near future, particularly loans to Southeast Asian borrowers.

"Asset quality will likely deteriorate mildly because of loan seasoning and possibly higher interest rates. The deterioration in cross-border loans will be more acute compared to domestic loans," the report said.

"The banks’ problem loan ratios have historically exhibited higher levels outside of Singapore, namely in emerging

markets that tend to have higher asset-quality risks than Singapore such as Southeast Asia (excluding Singapore), India and the Middle East. While problem loans in countries such as the United Arab Amirates have been gradually written off, we note that problem loans in Southeast Asia--particularly Indonesia and Thailand--have been on the rise since 2013," Moody's said.

Advertise

Advertise