Local firms' payment performance nosedives to three-year low in Q1

Delayed payments made up 45.8% of all transactions during the quarter.

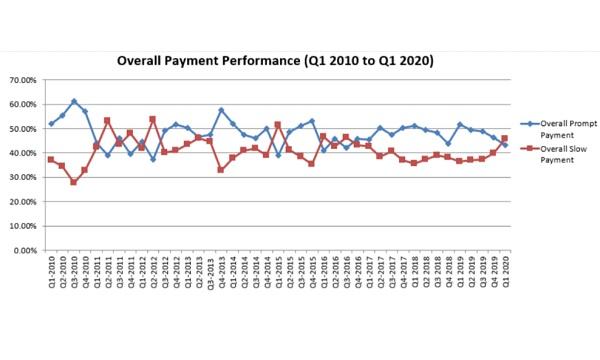

The payment performance of Singaporean firms fell to a three-year low in Q1, with prompt payments—or payments made on-time with the deadline—accounting for only 43.2% of total payment transactions during the quarter, according to data from the Singapore Commercial Credit Bureau (SCCB).

On a yearly basis, prompt payments dropped 8.5 percentage points (ppt) to 43.2% in Q1 from 51.7% in Q1 2019. Prompt payments hit a previous low of 42.18% in Q3 2016.

In contrast, slow payments—or payments made past the billing term—jumped 6.05 ppt to 45.8% in Q1 from 39.75% in Q4 2019. Slow payments also saw a 9.21 ppt spike compared to the 36.59% recorded a year earlier.

Meanwhile, partial payments made up to 11% of transactions in Q1, down 3.02 ppt from 14.% in Q4 2019 and 0.71 ppt from 11.71% in Q1 2019.

The share of slow payments spiked across all five industries, with manufacturing and services sectors seeing the largest YoY increases.

“The marked deterioration in payment performance is a clear sign that firms are struggling to meet their debt obligations with creditors. The services, manufacturing and construction companies have in particular been the hardest hit. We are expecting the downtrend in payment performance to continue as firms are exposed to a higher risk of payment delinquency in the months to come,” said Audrey Chia, D&B Singapore’s CEO.

Slow payments from manufacturers of petroleum and coal jumped to 42.46% in Q1 from 33% in Q4 2019. This is followed by manufacturers of chemical products, up by 6.13 ppt to 37.63% during the quarter from 31.5% previously. Payment delays by manufacturers of lumber and wood products also rose by 5.59 ppt to 39.59% in Q1 from 34% in Q4 2019.

A jump in payment delays within the recreational, hotels and accommodation and social services sub-segments drove the services sector to register the largest increase in slow payments, up 9.19% YoY to 43.68% in Q1 from only 34.49% in Q1 2019. The recreational services sub-sector registered the highest increase in slow payments, up by 13.60 ppt to 52.1% in Q1 from only 38.5% in Q4 2019. Hotels and accommodation saw their slow payments increase to 34.43% in Q1, from 29.5% in Q4 2019. Social services’ slow payments jumped to 56.77% in Q1 from 52% in the preceding quarter.

All construction sub-sectors saw increases in their payment delays. The building construction sector's slow payments rose to 54.2% in Q1, up by 2.70 ppt from 51.5% in Q4 2019. Slow payments within the heavy construction sector went up by 5.72 ppt from 49% in Q4 2019 to 54.72% in Q1. Delays within the special trade sector took up more than half of the share of payment transactions during the quarter at 50.15%, from 47% previously.

Meanwhile, a large rise in payment delays by retailers of apparels and automobiles drove the retail sector’s payment delays to increase moderately to 41.6% in Q1 from only 38.8% in Q4 2019. Automobile retailers’ slow payments made up 50.51% of all payments in Q1 from 44% in the previous quarter; whilst retailers of apparels saw their delayed payments rise to 41.4% from 36.5% over the same period of comparison.

The wholesale trade sector’s payment delays rose to 40.58% in Q1 from 36.79% in Q4 2019 and 34.25% a year earlier. Slow payments by wholesalers of durable goods rose by 5.65 ppt from 36.5% in Q4 2019 to 42.15% in Q1; whilst payment delays by wholesalers of non-durable goods rose to 39.45% in Q1 from 35.5% in the preceding quarter.

Advertise

Advertise