Singapore Companies Eye Vietnam to Navigate Manufacturing Shifts, Green Transition, and the AI Revolution

By Chris Malone and Quan DoanVietnam's location in Southeast Asia links major Asian markets, backed by a young workforce and expanding middle class.

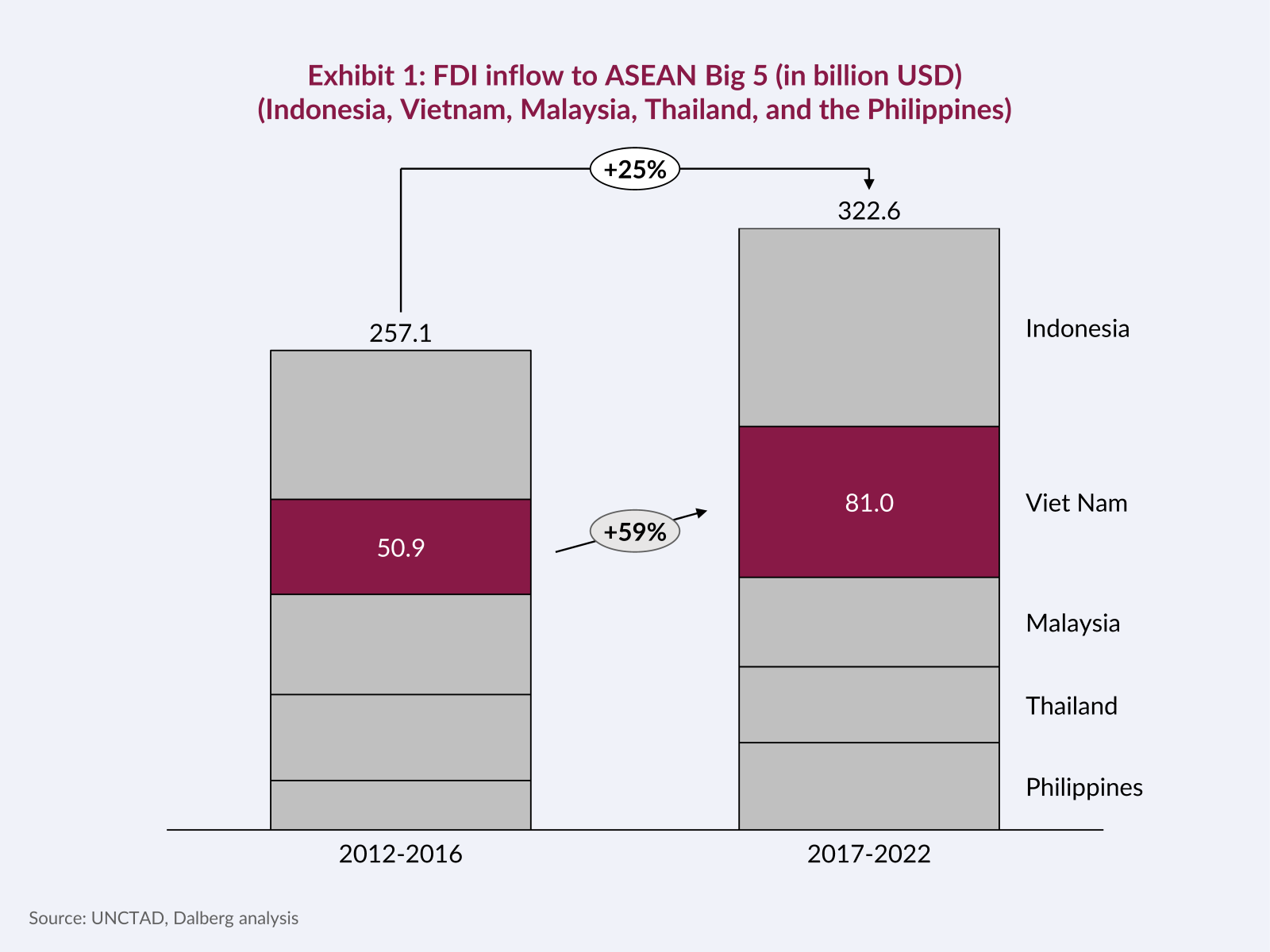

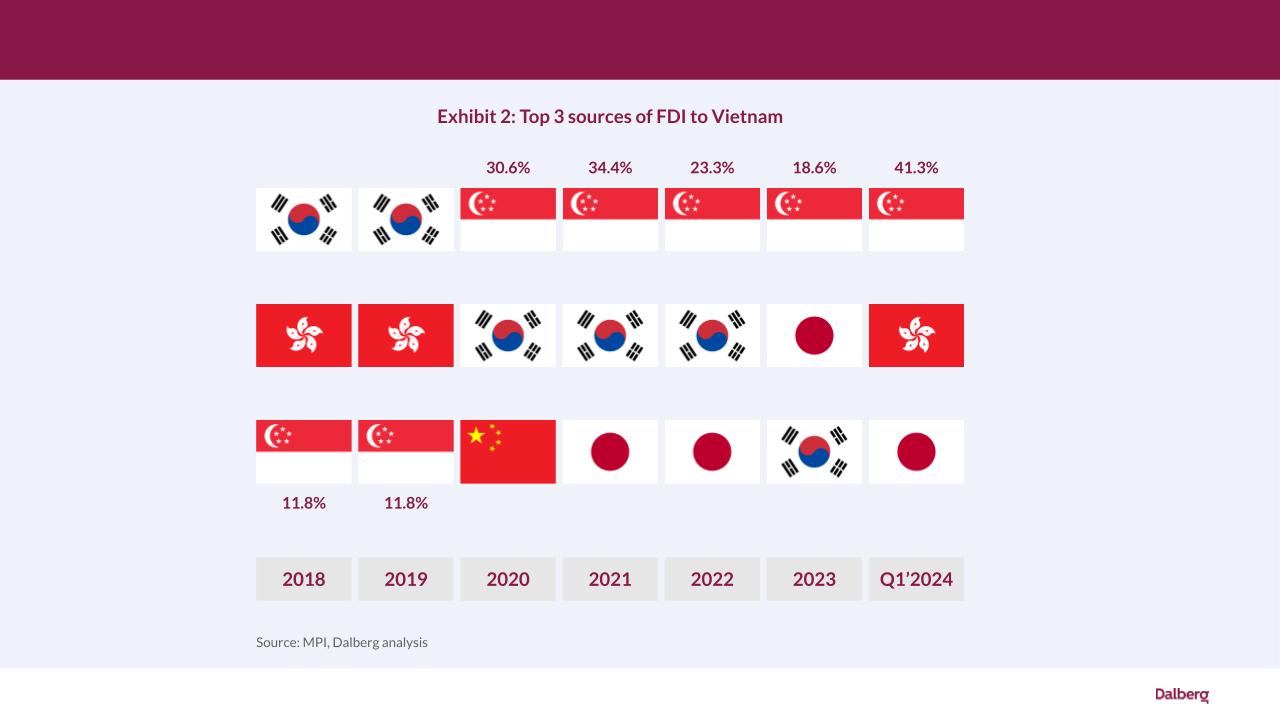

Singapore’s role as the leading investor in Vietnam has become increasingly pronounced over the last five years. According to the United Nations Conference on Trade and Development (UNCTAD), Foreign Direct Investment (FDI) in Vietnam rose by an extraordinary 59% — from $51.0 billion in 2012-2016 to $81.0 billion in 2017-2022. And Singapore has been at the forefront of this investment surge. Between 2021 and 2023, it made investments worth $24 billion, representing 25% of the total FDI inflow into Vietnam — the highest among all countries.

Singapore’s investment trajectory has not only sustained but also diversified over the years, with an initial focus on high-end residential projects through major developers like Keppel Land and CapitaLand and subsequent entry into sectors such as education, energy, food services, food manufacturing, infrastructure, and manufacturing through Enterprise Singapore.

What makes Vietnam the ideal investment destination for Singapore?

Vietnam’s burgeoning economy holds great investment potential for the island country. Once a nation heavily reliant on agriculture, Vietnam has now emerged as a key player in labor-intensive industries such as textiles and garments as well as high-value sectors such as electronics manufacturing. This shift has been fueled by a combination of robust foreign investment, forward-thinking government policies, and the country’s natural and social resources.

Geographically positioned in the heart of Southeast Asia, Vietnam serves as a critical gateway to major Asian markets, including China and the ASEAN countries, that play a key role in global supply chains. The country's demographic profile features a young workforce and a burgeoning middle class that together supports labor-intensive industries and fuel domestic demand for diverse services and products. Additionally, Vietnam's stable political climate and targeted economic policies further improve the overall business environment.

Vietnamese leadership has also taken steps to enhance infrastructure, including in transport, logistics, and energy, and streamline administrative processes to ease business operations. For instance, as directed by Prime Minister Phạm Minh Chính, the nation has accelerated the disbursement of investment capital for essential projects to stimulate economic development.

Three key global trends are bolstering investments into Vietnam

Vietnam’s growth trajectory is set to continue, bolstered by three global meta trends that offer substantial economic opportunities, each presenting a 20-year transition period for the country to fully capitalize. The first is the shift in manufacturing away from China, a transition in which Vietnam is currently in its middle stages, approximately 10 to 15 years in. The second, the nascent green energy transition, is in its early 5-year phase, marking a critical pivot towards sustainable development. Finally, the advent of economic restructuring driven by artificial intelligence presents a new and exciting frontier, one where Vietnam is just beginning its journey.

The manufacturing landscape is shifting significantly from China to Vietnam, as escalating labor costs in China and the ongoing US-China trade tensions have compelled companies to explore more cost-effective alternatives. Major brands such as Nike and Adidas have already established substantial production bases in Vietnam. Nike, for instance, produces 50% of its footwear and 29% of its apparel in Vietnam, surpassing production in China. The trend extends to high-tech manufacturing as well. Several Chinese suppliers as well as global electronics giants such as Samsung and Apple have set up operations in Vietnam. This shift is underscored by recent visits from high-profile executives such as Apple’s CEO Tim Cook, who highlighted the company’s increasing investment in Vietnamese suppliers, which surged to $15.84 billion. The influx also includes major players like Foxconn, GoerTek, Luxshare, Intel, Samsung Electronics, and Compal.

In its green transition, Vietnam is capitalizing on its natural advantages in the renewable energy sector: a long coastline,strong winds, and abundant sunshine. This aligns with its national strategy to transition to diverse energy sources and reach net-zero emissions by 2050. According to UNCTAD, between 2015 and 2022, Vietnam attracted $106.8 billion in FDI in renewable energy, ranking it second among developing economies. To fully transition its energy sector, Vietnam needs an estimated $86 billion by 2030 and $370 billion by 2050. The nation has demonstrated a strong commitment to green energy transition. At the 2023 United Nations Climate Change Conference (COP28) in Dubai, Prime Minister Phạm Minh Chính unveiled a Resource Mobilization Plan under the Just Energy Transition Partnership (JETP) with the International Partnership Group. Beyond energy, Vietnam is exploring other green investment avenues. For instance, Ho Chi Minh City is seeking investments for 28 projects worth over $6.7 billion that focus on green growth.

While still in its early stages of AI development, Vietnam is encountering challenges due to a lack of specialized expertise and inadequate regulatory frameworks. Despite these hurdles, the country is making significant strides under its National Digital Transformation Program scheduled from 2025 to 2030. Plans are in place to establish national centers for big data, supercomputing, and AI innovation centers aimed at attracting startups and investments. This strategic initiative has already yielded results, with Oxford Insights reporting that Vietnam climbed to the 39th rank in AI readiness in 2023, up from 55th in 2022. Furthermore, FDI interest in Vietnam's AI sector is intensifying. Notable examples include Meta and Atmo, an American firm specializing in AI-based multinational weather forecasting.

The opportunity for Singapore

These trends serve to reiterate that Vietnam remains a major opportunity for Singapore companies, with its economy expected to grow from $327 billion in 2022 to $760 billion by 2030. Meanwhile, the Vietnamese government is enhancing the investment climate through infrastructure improvements, foreign relations, and policy reforms, creating favorable conditions for Singaporean businesses. However, challenges such as complex administrative procedures and infrastructural inefficiencies persist. Singaporean investors considering opportunities in Vietnam must stay informed about recent policy changes, such as the implementation of the global minimum tax regime starting January 1, 2024, which could impact investment strategies and outcomes.

Chris Malone is a Partner at Dalberg Advisors, based in Singapore. Quan Doan is a Project Manager at Dalberg Advisors, based in Vietnam.

Advertise

Advertise