Monthly transactions in PayNow cross $1b mark

Over 3 million in combined mobile and NRIC numbers are registered to the service.

The value of PayNow transactions per month crossed the $1b mark for three consecutive months since July, announced the Association of Banks in Singapore (ABS).

As at 30 September, more than 120,000 UENs and close to 3 million in combined mobile and NRIC numbers are registered with PayNow.

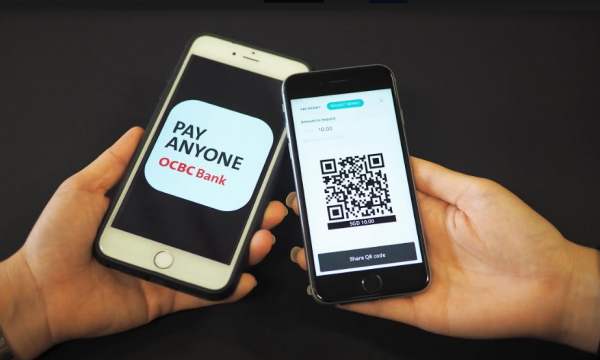

PayNow, a peer-to-peer funds transfer service, can be used for utilities bill payments, tuition fee payments and insurance payouts.

A similar service for businesses, PayNow Corporate was launched in August 2018 to enable businesses to pay and receive funds across nine PayNow participating banks instantaneously by linking their Unique Entity Number (UEN) to their Singapore bank account.

The nine banks offering PayNow are Bank of China, Citibank Singapore, DBS Bank/POSB, HSBC, ICBC, Maybank, OCBC Bank, Standard Chartered, and United Overseas Bank (UOB).

Advertise

Advertise