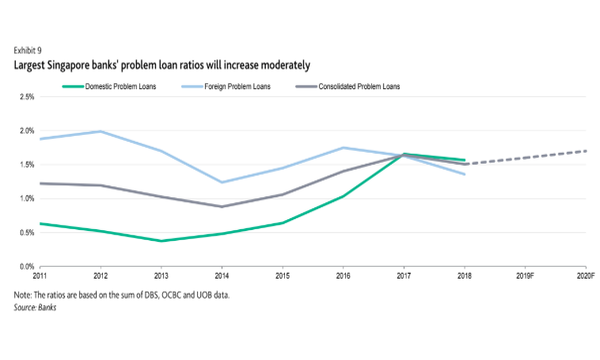

Singapore banks' bad loan ratio to hit 1.7% by 2020

Blame higher delinquencies from SMEs and non-financial firms.

The volume of soured assets held by banks in Singapore are set to rise mildly amidst delinquencies amongst SMEs and non-financial firms with the bad loan ratio tipped to hit 1.7% by the end of 2020 from 1.5% in 2018, Moody’s said in a report.

“SMEs are particularly vulnerable to Singapore's economic slowdown, and these loans made up about 10% of loans at the three largest banks. The rate of new problem loan formation has started to rise modestly since reaching multiyear lows in 2018, with the increase driven by SMEs and commodity-related corporates,” Moody’s explained.

The systemwide gross NPL ratio for loans to Singapore-based SMEs rose to 5.1% in June 2018 from 4.6% in 2017 and 2.8% in 2016.

Also read: Bad loans haunt Singapore banks as asset quality risks mount

The share of debt held by weak listed non-financial firms is also likely to pick up in 2019 amidst weakening corporate earnings. The figure fell to 7% in 2018 from 9%.

“Companies with net debt that exceeds EBITDA by more than four times or with negative EBITDA, accounted for 76% of total debt held by listed non-financial firms at the end of 2018, little changed from a year earlier,” Moody’s explained.

The quality of offshore and marine exposures should remain stable but weak, depending on oil prices. According to Moody’s, outstanding exposures for the three large banks made up 1-2% of gross loans at the end of 2018, with a very high impairment rate of around 50% and were the main contributor of new non-performing loans in 2016-2017.

For household loans that were predominantly mortgages, Moody’s predict that NPL ratio will stay low as the strong labor market and macroprudential measures limit credit growth in this segment at about 1% as regulatory restrictions on the origination of riskier mortgages help banks maintain strong asset quality.

“Singaporean banks have a very small share of mortgages with loan-to-value (LTV) ratios exceeding 80% in their loan portfolios because of a ban on such loans that has been in place since 2013 and their average LTV ratio,” the firm said.

Moody’s said that the overseas problem loan ratios for the three largest Singaporean banks were stable or declined in 2018 across the ASEAN region, including the core markets of Malaysia, Thailand and Indonesia, as well as in China and Hong Kong.

Advertise

Advertise