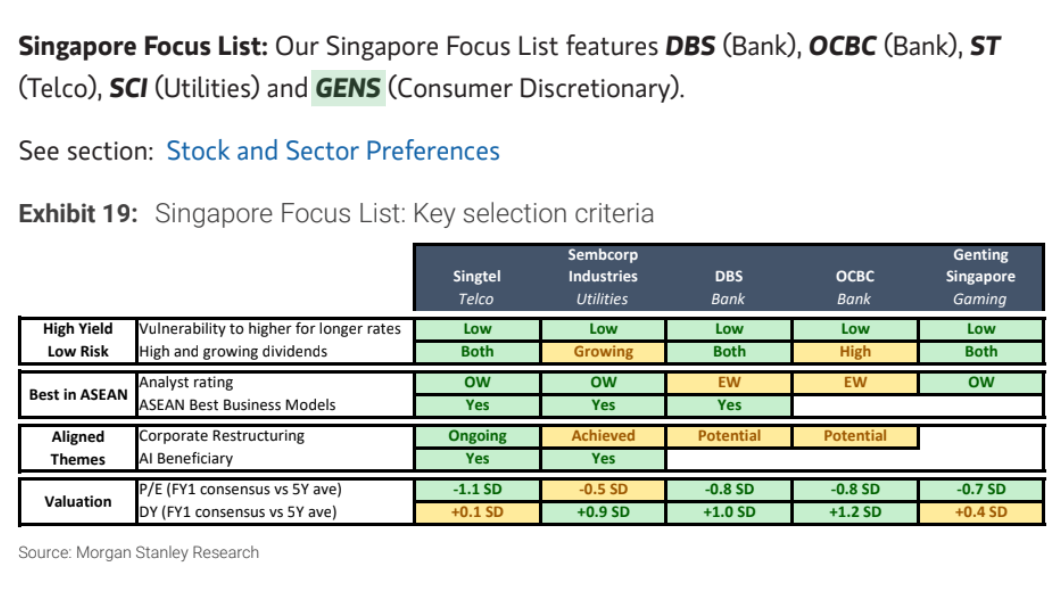

Chart by Morgan Stanley

Chart by Morgan Stanley

Banks, utilities top Morgan Stanley's top stocks in Singapore

DBS, OCBC, Singtel, Sembcorp and Genting are its top picks.

Defying global uncertainties, Singapore’s equity market is well-positioned to benefit from elevated interest rates with high-dividend stocks and companies riding the AI boom leading the upswing, according to Morgan Stanley.

Equity analysts and economists at the bank said in a recent note that businesses aligned with key global investment themes of AI tech diffusion and corporate restructuring are set to outperform over the medium-term.

As the timing of the US Fed rate cut remains unclear, Morgan Stanley said the high dividends and defensive qualities that top Singapore stocks offer are valuable to weathering the storm.

It recommended positioning in stocks and sectors that could ride the global trends as well as those with high-yield and low-risk features as they will stay resilient in an elevated interest rate environment.

Morgan Stanley included two of Singapore’s largest lenders, DBS Group Holdings and Oversea-Chinese Banking Corp (OCBC) in its “Singapore Focus List” where they chose the five stocks that investors should bet on over the next 12 months.

Telecom giant Singapore Telecom (Singtel), utility and urban solutions provider Sembcorp Industries and casino and resorts operator Genting Singapore also made it to the list.

“Our selection criteria includes alignment with critical investment themes that are global, such as AI tech diffusion as well as rather uniquely local, such as corporate restructuring,” the note read.

Singapore’s equity market currently provides attractive valuations as a result of the heavy outflows since 2022. Its dividend yield of more than 5% is also considered high compared to its developed market peers globally.

“High and sustained growth in dividends, we believe, can meaningfully bolster portfolio relative total returns for investors,” according to the note.

Placing big bets on firms undergoing corporate restructuring will also allow investors to reap the benefits of these exercises meant to make companies more competitive.

On the booming AI adoption, Morgan Stanley pointed out that Singtel and Sembcorp have a growth opportunity in the power-hungry space of infrastructure and data centres.

With the five stocks still included in the MSCI Singapore Index, all of them also stand to benefit from rotational flows from off-index alternatives following the latest stock deletions, according to the analysts.

By sector, Morgan Stanley said they are most optimistic about the banks as they offer the highest dividend yields among the large-cap stocks.

“Selected names within the Telecoms, Consumer Discretionary, and Utilities also have a good fit. We would be selective on the Industrial and Real Estate where stock remaining on the MSCI Singapore index could benefit from rotations in allocation,” it added.

Advertise

Advertise