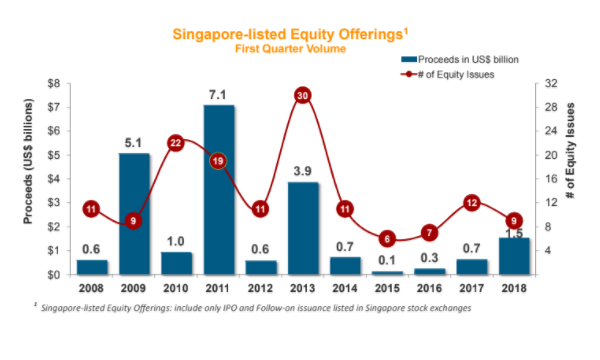

Chart of the day: Equity offerings hit 5-year high at US$1.5b

This was driven by follow-on offerings which soared 133.4% to US$1.2b.

This chart from Thomson Reuters shows that Singapore-listed equity offerings surged by 134.8% to US$1.5b so far this year, marking the strongest start to a year since 2013.

According to a report, this was driven by follow-on offerings in Singapore stock exchanges that raised US$1.2b in proceeds, up 133.4% from a year ago. Initial public offerings (IPO) listings raised US$315.6m, up 140.7% from the first quarter of 2017.

South Korean messaging app operator Kakao Corp raised US$1b from the sale of global depository receipts in Singapore Exchange. Sasseur REIT’s US$300.7m IPO is the biggest IPO listing in the Singapore Exchange so far this year.

Equity offerings are combined with initial public offerings and follow-on offerings listed in Singapore’s stock exchanges.

Advertise

Advertise