Chart of the Day: Singaporean investors more cautious in saving up for retirement

The majority have spent more time considering their financial wellbeing due to the pandemic.

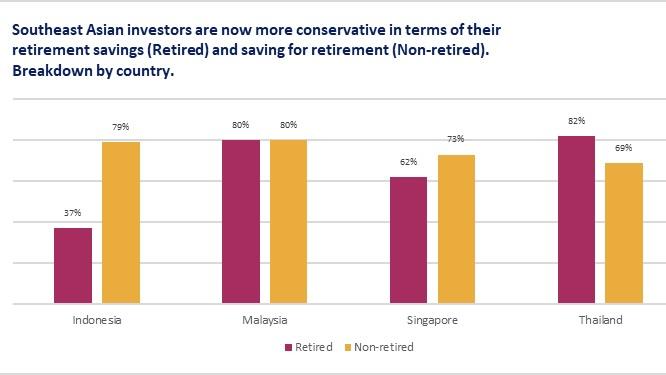

This chart from Schroders shows that more Singaporean investors are gearing up savings for their retirement, a trend seen across other Southeast Asian markets as well.

Seven in 10 or 73% of non-retired Singaporean investors said that they have become more cautious in terms of their retirement savings, whilst 62% of retired Singaporean investors said the same.

Over eight in ten or 81% of Singaporeans surveyed by Schroders indicated that they have spent more time considering their financial well being and reorganizing their personal finances since the onset of the pandemic.

The trend is observed also in Thailand, where over nine in ten or 91% of surveyed investors indicated the same. Investors from Indonesia (88%) and Malaysia (85%) also shared this view strongly.

A greater focus on financial well-being and savings is set to be amongst the lasting legacies of the pandemic for SEA investors, Schroders said.

“Investors globally are now more likely to check their investments at least once a month at 82%, compared with 77% of investors in 2019,” the study read.

Additionally, over half of SEA investors (52%) said that they will likely save more once the COVID-19 situation eases, higher than the global average of 46%.

Schroders conducted its Global Investor Study 2021 between March to August this year, surveying nearly 24,000 individuals across 33 locations across the world.

Many parts of SEA were closed-off at the time, battling new waves of infections that caused new lockdowns on top of slow vaccine rollouts—which might have resulted in the more cautious outlooks from investors in the region, Schroders said.

Advertise

Advertise