Golden Equator Capital raises $122.11m for two funds

This will finance the growth capital of an undisclosed public listed company and focus on infrastructure, energy, and finance.

Singapore’s Golden Equator Capital (GEC) has raised two private capital funds totalling $122.11m (US$90m) for the growth capital of a public listed company in the region. According to an announcement, institutional investors in Singapore, Japan and Korea joined the funding.

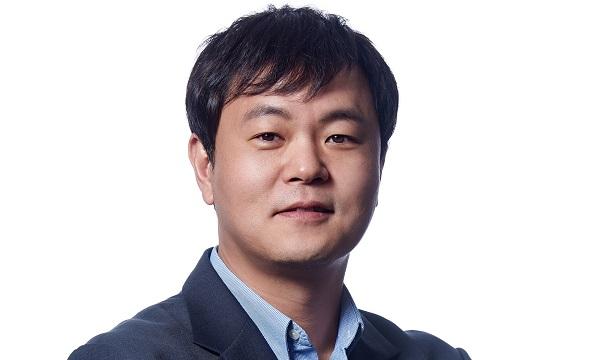

The private capital funds primarily focus on the infrastructure, energy, and financial sector, and are led by Jacob Jiwon Kim, managing partner at Golden Equator Capital.

Kim said, “Asia has historically been a market financed by Western banks, but with these lenders scaling back in Asia in the last decade, the gap in the much-needed growth-financing for Asia’s emerging economies has been growing. At the same time, there is a lot of capital in developed Asian markets such as Japan and Korea that’s looking for investments with stronger returns than their domestic markets.”

Following the launch of its two private capital funds, GEC targets to raise a blind fund in the range of $271.35m (US$200m) next year. Meanwhile, the fund manager said it continues to work on additional projects and could launch a few more project funds.

The private capital funds will cover private debt and mezzanine financing for companies and projects in Southeast Asia.

GEC is a Singapore-based fund management company holding a Capital Markets Services (CMS) license, a business under Golden Equator Group. GEC currently has five funds: two private capital funds and a prime currency income fund, besides its two venture funds.

Advertise

Advertise