Singapore firms' payment performance weakened in Q2

Prompt payments fell slightly by 1.65 ppt to 49.55% of total transactions.

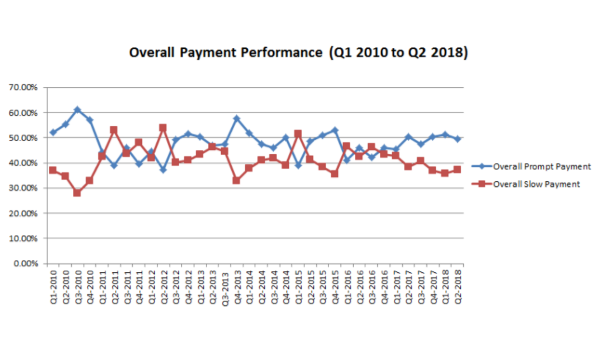

The payment performance of local firms has weakened slightly in the second quarter of 2018 after two consecutive quarters of improvements, the Singapore Commercial Credit Bureau (SCCB) revealed.

Prompt payment (90% or more of total bills are paid according to terms) inched lower marginally below half of total payment transactions, whilst slow payments (less than the 50% of bills are paid) accounted for more than one-third of total payment transactions.

On a QoQ basis, prompt payments fell slightly by 1.65 ppt from 51.20% in Q1 2018 to 49.55% in Q2 2018. They fell by 0.76 ppt YoY from 50.31% in Q2 2017 to 49.55% in Q2 2018.

Slow payments rose slightly by 1.44 ppt QoQ from 35.74% to 37.18%. However, they dropped by 1.29 ppt YoY from 38.47% to 37.18%.

Meanwhile, partial payments inched upwards by 0.21 ppt QoQ from 13.06% to 13.27%. They rose slightly by 2.05 ppt YoY from 11.22% to 13.27%.

Partial payment refers to when between 50% and 90% of total bills are paid within the agreed payment terms.

Across sectors, the construction sector continued to improve its payment performance as slow payments fell from 49.14% in Q1 to 47.33% of the total in Q2. However, slow payments increased 2.17 ppt YoY.

Slow payments within the manufacturing sector grew 2.12 ppt QoQ from 36.88% to 39% due to an increase in payment delays by manufacturers of apparels and other textile, tobacco and rubber.

The retail sector recorded the lowest proportion of slow payments, as they fell 0.86 ppt QoQ from 29.98% to 29.84% of the total. However, payment delays have increased slightly among retailers of apparel and accessories, building materials, furniture, and home furnishings.

The payment performance of the services sector improved slightly as slow payments dipped 0.65 ppt QoQ from 38.19% to 37.54% of the total. Payment delays in the sub-sectors automobile services, consumer services, and legal services all decreased.

Meanwhile, the wholesale trade sector recorded the largest increase in payment delays from 32.78% to 36.94% due largely to a rise in slow payments within the wholesale trade of durable goods.

D&B Singapore CEO Audrey Chia commented, “On the overall, payment performance has remained at relatively healthy levels despite the slight increase in slow payments from the previous quarter. We have also seen a spike in partial payments within the manufacturing and wholesale trade sectors over the past quarter which is a positive sign as well. From a year-on-year perspective, both partial payments and slow payments have improved on the back of growth within the manufacturing, retail and services compared to a year ago.”

Advertise

Advertise