Chart from LSEG

Chart from LSEG

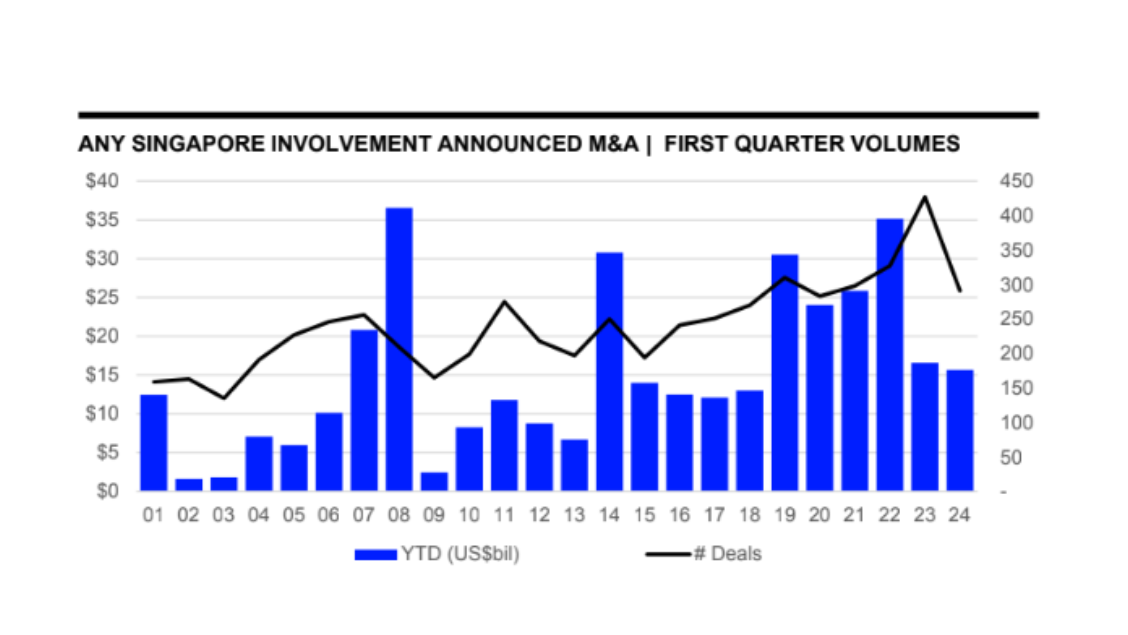

Singapore M&A suffers 5.5% YoY decline in value

Both inbound and outbound M&A deals also declined in 1Q24.

The value of mergers and acquisitions (M&A) transactions with Singapore involvement fell 5.5% YoY to US$15.7b in 1Q24, data from the London Stock Exchange Group (LSEG) showed.

The value of M&A deals targeted at companies based in Singapore also declined in 1Q24, dropping 38.2% YoY to US$2.5b.

In 1Q24, LSEG said Consumer Products & Services was the most targeted sector by value, accounting for 25.8% of M&A activity (US$4.0b), a six-fold increase from 1Q23.

Industrials and Financials were close behind with 14.6% and 14.0% market share, respectively.

Despite having the highest number of deals, the High Technology sector only captured 8.5% market share (US$1.3b) in value, translating to a 42.5% drop YoY.

Amongst companies, BofA Securities leads the M&A league tables, capturing US$1.67b in deal value or a 10.64% market share.

Meanwhile, LSEG also reported the value of domestic, inbound and outbound M&A activities declined in the first quarter, falling 52.7% YoY to US$1.0b, 20.1% YoY to US$1.4b, and 49.0% YoY to US$5.0b.

Advertise

Advertise