News

Office rents edged down 3.2% in Q4 2019

Office rents edged down 3.2% in Q4 2019

Demand is expected to be subdued in 2020 due to companies’ budget restraints for expansion. Office space rents saw a decrease of 3.2% in Q4 2019, a bigger plunge compared to the 0.6% slide in the previous quarter, according to a report by the Urban Redevelopment Authority (URA). For the whole of 2019, office space rentals declined 3.1%.

Home prices jumped 2.7% in 2019: URA

Prices of landed homes grew 5.7% for the whole year. Prices of private homes leapt 2.7% YoY for 2019, according to the Urban Redevelopment Authority (URA). For Q4 2019, prices also grew 0.5%. Prices of landed residential properties rose by 5.7% whilst those of non-landed properties rose by 1.9%. For Q4 2019, prices of landed and non-landed properties increased by 3.6% and fell by 0.3% respectively. For the whole of 2019, prices of non-landed properties in Core Central Region (CCR) decreased by 1.7%, whilst prices in Rest of Central Region (RCR) and Outside Central Region (OCR) increased by 2.8% and 4.2% respectively. Home rentals Rents also enjoyed growth in 2019, having risen by 1.4% compared to the 0.6% increase in 2018. For Q4 2019, rents dipped 1%. Rentals of landed properties decreased by 3.4% whilst rentals of non-landed properties increased by 1.9%. For Q4 2019, rentals of landed and non-landed properties both decreased by 1.6% and 0.9%, respectively.

Singapore's Temasek and EQT launch O2 Power platform in India

It will target over 4GW of installed capacity across solar and wind.

Mapletree Commercial Trust's NPI up 17.6% to $103.30m in Q3

Its office and business park assets’ gross revenue and NPI rose.

Frasers Centrepoint Trust's NPI up 2.6% to $36.32m in Q1

Income from PGIM ARF boosted its growth.

Novelship fills the gaps in the sneakers reseller market

It acts as an “gatekeeper” for authenticity and product condition.

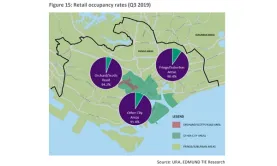

Chart of the Day: Retail occupancy rates in Orchard/Scotts Road hit 94.2% in Q3 2019

The area posted the highest occupancy rate for retail properties.

Daily Markets Briefing: STI up 0.21%

Capitaland led the gains amongst top active stocks with a 1.3% expansion.

Daily Briefing: CPF rolls out online nominations; Hewlett-Packard, NTU unveil new 3D printing courses

And Singapore is named as a destination with the richest multigenerational family offerings.

Singapore dominates mobile payment market for Chinese tourists

77% of Chinese tourists in the city use mobile payments.

Keppel DC REIT's NPI climbed 12.4% to $177.28m in 2019

Full- year contributions from Keppel DC Singapore 5 boosted its distributable income.

CapitaLand Commercial Trust NPI up 2.1% to $321.22m in 2019

It received higher gross revenue from 21 Collyer Quay and Capital Tower in Q4.

Grab to revamp rewards programme in March

Users of Grab’s Mastercard can earn points at over 53 million merchants worldwide.

Digital banks won't be a threat to big Singaporean banks: analyst

Singapore poses as a hard-ground for virtual entrants.

Mapletree Industrial Trust's NPI grew 14% to $81.91m in Q3 2019

Improved occupancy from its business park buildings drove growth.

CMT and CCT merge to form Singapore's largest REIT

It is set to be CapitaLand’s primary investment vehicle for commercial real estate in Singapore.

CapitaLand Mall Trust's NPI up 13.1% to $558.22m in 2019

The acquisition of Infinity Mall Trust was its main revenue driver.

Advertise

Advertise

Commentary

Why Singapore businesses must focus on outvaluing, not just upskilling

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform