News

Chart of the Day: Foreigners snapped up 18.2% of Parc Clematis units

Chart of the Day: Foreigners snapped up 18.2% of Parc Clematis units

Its proximity to NUS, Jurong East, and One-North enhanced its appeal.

Daily Markets Briefing: STI down 0.01%

OCBC led the gains amongst top active stocks with a 0.55% rise.

MAS rejects aggressive policy easing despite weak economic growth

It expects GDP growth, business costs, and consumer prices to stabilise.

Chart of the Day: Residential mortgagee sale listings up 14.4% in Q3

This marks the sixth consecutive quarterly increase since Q2 2018.

Daily Briefing: ST Telemedia leads $54.41m funding round in US-based analytics firm; HDB to set up 6,000 digital screens in housing estates

And employment-seeking platform GrabJobs expands to Indonesia.

Daily Markets Briefing: STI up 0.68%

Singtel led the gains amongst top active stocks with a 1.23% rise.

Women occupy less than 14% of boardroom seats in Singapore: report

About 6% of board chair positions are assumed by women.

2GWp of solar power to be deployed by 2030

The government is exploring vertical solar panel installations.

SP Group to issue international green energy certificates

It also fully automated its digital REC trading platform.

URA launches tender for Irwell Bank Road site

It can yield up to 445 residential units.

Yanlord bags $334m in Huangzhou apartment presales

All 120 apartment units were sold out for an average price of $13,805.85 psm.

AirCarbon launches first blockchain-based carbon exchange

It will be fully operational in 2020.

Sheng Siong profits up 16.4% to $20.59m in Q3

Its new store openings boosted revenues.

Changi Airport passenger movements up 4.7% in September

Passengers from Japan led the airport’s traffic growth at 15%.

foodpanda launches delivery for groceries

The platform is offering free delivery on all shops throughout November.

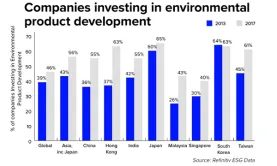

Singapore corporates lag in environmental sustainability

Only 40% of companies develop environmentally-conscious products.

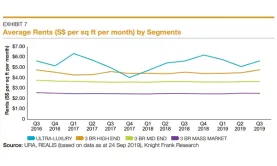

Chart of the day: Ultra-luxury property rents rose 10.6% in Q3

This reversed two consecutive quarters of decline.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform