News

Brace yourselves for a 1.3% inflation hike in 2018

Brace yourselves for a 1.3% inflation hike in 2018

No thanks to price pressures on fuel, water, and utilites.

Number of online jobs grew 9.6% in Q4

The hunt for online jobs in the banking and healthcare sectors recovered.

M1's earnings feared to slide 12%

This is due to a looming increase in the company’s expenses.

CapitaLand Mall's net property income fell 2.9% to $478.2m in 2017

How did Funan Mall closure affect its figures?

Mapletree Industrial Trust's property income increased 11.7% to $70.7m in 3Q2018

Revenue also went up, thanks to built-to-suit project for HP Singapore.

Suntec REIT's net property income rose 8.9% to $244.5m in 2017

It was boosted by higher revenue, which increased to $354.2m.

Warehouse rentals fell by 4.9% in Q3

The industrial market faced a surge in supply.

Businesses can waste $10.1b from bureaucracy woes

They also waste 5.5% time due to administration.

Freehold residential site Makeway View to en bloc

The owners set an asking price of $168m or $1,589 psf ppr.

GLP goes private and closes Singapore's largest M&A deal

It delisted from the SGX-ST on 22 January.

Frasers Centrepoint Trust's NPI up 9.1% to $34.51m in Q1

Portfolio occupancy rate slightly improved from 92% to 92.6%.

Almost half of Singaporeans are unhappy at work

Management woes drive unhappiness at work.

Daily Briefing: Anti-graft law undergoes review; Singapore to improve tax use for social issues

And here's how to start buying insurance in Singapore.

Daily Markets Briefing: STI up 0.63%

Expect some good news today.

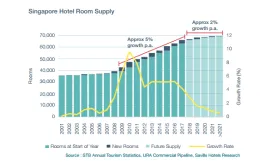

Chart of the Day: Total hotel room supply rose 67.9% from 2009 to 2017

On average, 2,970 rooms were added a year for nine consecutive years.

M1 net profit down by 11.5% to $132.5m in 2017

This was due to increased depreciation and amortisation expenses.

Industrial occupancy dips despite growth of space supply

Occupancy rate fell from nearly 90% in 2016 to 87% in 2017.

Advertise

Advertise

Commentary

Why Singapore businesses must focus on outvaluing, not just upskilling

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform