News

Check out these crazy long queues for the iPhone5 in Singapore

Check out these crazy long queues for the iPhone5 in Singapore

The 64gb was immediately sold out at the M1 shop at the Paragon.

Manufacturing company Scintronix responds to SGX queries

SGX investigates why the Company has chosen to proceed with the proposed placement of 814,371,793 new ordinary shares.

Dairy Farm rejoices while Carrefour Malaysia spirals down

A competitor may buy Carrefour for US$300m but Dairy Farm shrugs it off.

Here are 3 areas UOB-SMU Asian Enterprise Institute will target

The institute is the first of its kind in Asia.

You won't believe how many Singaporeans indulge in personal tasks during work hours

77.1% confess that they are guilty.

Check out how the upcoming Thomson Line impacts on property projects nearby

Old condos in Sin Ming station will likely see prices breach SGD1,000psf.

5 best selling residential projects in August

One Dusun Residences topped the sales chart.

Ministry of Home Affairs issues statement on 'Innocence of Muslims' film

Singaporeans 'urged' to refrain from re-posting the video.

These are the people who vow to manage Raffles Education's business risks

Raffles Education has made its own Risk Management Committee.

Here's why young Singaporeans won't freak out in retirement

Male and female workers will hit 71%, 63% IRR through savings.

Ship ahoy: NOL to veer towards profit gains amid EU, US stimuli

FY2013 PATMI forecast is pegged at USD102m.

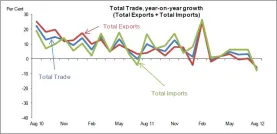

Chart of the Day: Total trade down 7.1% in August 2012

Total exports slipped by 5.9% while total imports fell by 8.3%.

Stringent scrutiny of listed companies here to stay, warns SGX CEO

Find out what SGX has done so far this year in support of higher regulatory standards.

Get a glimpse of how much Singapore Press Holdings' jewels cost

Paragon retail mall's revaluation rose 4.7% to SGD2.43bn.

Genting Singapore to lose $16m on Echo disposal

DBS says share price is already back to pre-Echo levels.

StarHub to offer iPhone 5 from 21 September

Plans start at $0 for the 16GB and 32GB models, and $78 for the 64GB model.

The 3 powerhouses of Singapore's economy slowly faltering

Guess which companies are now overtaking Singapore's 3 main growth drivers - manufacturing, wholesale, and finance?

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform