News

Raffles Medical Group revenue surges to $343.8m in H1

Raffles Medical Group revenue surges to $343.8m in H1

The group’s profits after tax ballooned by as much as 138.4%.

Temasek subsidiary launches three tranche USD bonds offerings

It is comprised of a 10-, 20-, and 40-year USD Temasek Bonds.

Temasek subsidiary launches three-tranche USD bonds offering

It is comprised of a 10-, 20-, and 40-year USD Temasek Bonds.

Golden Energy sees 'significant improvement' in 1H

This was linked to the higher average selling prices amidst rising coal prices.

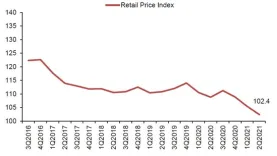

Chart of the day: Central region retail space prices continue to plummet

Retail space prices fall by 2.8% in the second quarter, continuing a trend seen since the third quarter of last year.

Daily briefing: GIC still optimistic over China tech; SG to extend $1.1b support amidst Phase 2 restrictions

And Taxis and private drivers to get $10 per day until end-August.

Market Update: STI down -0.06%

Most shares traded sideways on Friday, 23 July.

Hiring activity increased in June: Indeed

Job postings were 35.6% higher than 1 February 2020.

HDB resale prices climb for the 5th consecutive quarter by 3.0%

Resale volumes were at 7,063 during the first Phase 2 (Heightened Alert) period.

Higher adoption of QR payments ramps up Singapore’s cashless transition

In January, 1.2 million transactions were carried out via the SGQR.

Bid for Tampines EC site breaks records

Garnering 9 bids, the expected selling price of the site could fall between $1250 to $1300 psf.

Frasers Centrepoint Trust portfolio occupancy at 96.4% in Q3

The Singapore-focused mall operator sees its suburban properties recovering faster than its counterparts.

Virtual banking trumps branch banking amongst Singaporeans: study

But less than half of SEA respondents are excited by the digital services currented offered.

GREAT Green SP insurance fully-subscribed, closed: Great Eastern

Customers may invest between S$5,000 and S$100,000.

Citi rolls out real time liquidity sharing solution in APAC

Treasury teams can mobilize liquidity and fund intraday payments in real-time.

Moving to cloud can save Singaporean firms up to 76% in energy use: survey

Moving at least one megawatt of workload into the cloud could save a year’s worth of emission from 23,500 households.

Daily Briefing: Businesses ask landlords to share 'pain' in new round of restriction; Marina Bay Sands casino closed until 5 August

And Vietnam asserts not all Vietnamese do vice.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform