News

OCBC issues A$500m senior floating green notes at 0.26% rate

OCBC issues A$500m senior floating green notes at 0.26% rate

The notes will be issued in its Sydney, Australia branch.

Fintech startup STACS joins Mastercard’s startup engagement programme

STACS is amongst seven startups globally that were admitted into the programme.

MPA, SMI co-fund 3 consortiums for harbour craft electrification

This will support Singapore’s plans of reducing greenhouse gas emissions by the maritime transport sector.

Hong Leong Finance net attributable profit up 22.4% to $44.7m

The company ranks 665th in the Top 1000 World Banks 2021.

Singapore Fintech Festival 2021 to discuss Web 3.0 for financial uses

It will take place from 8 to 12 November as a hybrid event.

Singapore banks post robust net profit results

All three major banks reported net profits of more than $2b for the first six months of 2021.

Daily briefing: Singaporeans to get rental support payouts starting 6 August; HK media firm moves to SG

And MoM said employers cannot join maid in medical exams.

Market Update: STI Down 0.45%

ThaiBev and DBS lead with the most growth today.

SGX reveals $447m profit for FY2021

It points toward expansion as the driving factor of their success.

Keppel, SPH merger a good deal for both: UOB Kay Hian

Keppel is set to fully acquire SPH’s non-media businesses by end-December if shareholders approve.

ESR acquisition of ARA to make it largest real asset manager in APAC

ESR Cayman Limited is set to acquire ARA Asset Management for US$5.2b.

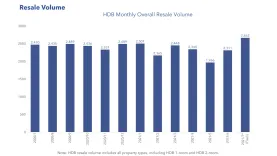

HDB resale prices jump 13.2% in July amidst ‘price bidding wars’

A total of 19 HDB flats were resold for at least $1m.

DBS profit up 54% to record S$3.71b in H1, 33 cents DPS announced

Fee income rose to a record as wealth fees hit new heights.

ST Engineering, Temasek set up freighter leasing joint venture firm

They will both have 50% share in the JV company.

FLCT gears for COVID-19 impact on its retail portfolio

COVID-19 had a $1.1m impact on Frasers Logistics & Commercial Trust’s distributable income for the first nine months of the financial year.

SGX achieves milestone Aa2 rating

The rating is the highest given to any exchange group by the investor service.

Keppel subsidiary forms joint venture with Shanghai Topchain

The joint venture company will manage investment properties with potential for asset enhancement initiatives in China.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform