News

Alcoholic drinks sector to rebound from 2021: report

Alcoholic drinks sector to rebound from 2021: report

Spending is set to grow by 2.6% annually over the medium term.

CapitaLand pushes ahead with its global drive for sustainability

The real estate group is adopting sustainability innovations through its CapitaLand Sustainability X Challenge and devising a new metric to measure its sustainability outcomes.

Singaporeans more lax in oral hygiene since pandemic: study

Change in lifestyle since the pandemic blamed for worsening oral hygiene.

Daily Briefing: SG to consider appeals for early vaccination for urgent overseas travel; How Sealed Network introduced expert networks to SEA

And Malaysian e-grocer Jocom raises $5.6m via listing on SG’s 1exchange.

S&P upgrades Yanlord Land Group rating

Yanlord Land was given a 'stable' rating.

CFOs should get more involved in new business models: report

More CFOs will stay actively involved in the company’s digitisation projects.

$940m wage credits to be released by end-March

This latest disbursement of the Wage Credit Scheme will affect over 98,000 employers.

Singapore next in line for travel bubble: Taiwan health minister

Singapore lifted restrictions for travellers from Taiwan in December 2020.

Top 10 tech stocks gain 15%

Singapore's technology stocks keep pace with global gains.

Mapletree acquires five properties in South Korea

The acquisition was first announced on 15 February.

Singapore reaffirms efforts to combat piracy, sea robberies

Minister for Transport Ong emphasised the need to protect global commons.

Zilliqa launches US$5m investment fund via ecosystem growth arm

ZILHive will offer support to promising talents and projects across the tech ecosystem.

Daily Briefing: More than 98,000 employers to get $940m in Wage Credit Scheme payouts by end-March; Futu taps retail trading frenzy from SG

And MRT train testing facility to be fully operational by 2024.

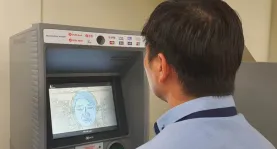

OCBC to roll out face verification in eight Singapore ATMs

The bank will extend the technology to all of its ATMs in Singapore progressively.

General insurers post flat growth in 2020

Underwriting profit reached $237.3m.

Revenue of Ascott and Frasers REITs to remain weak until 2023

But excellent liquidity will help them through the industry turmoil.

Jardine Cycle & Carriage offers to buyout Cycle & Carriage Bintang

Cycle & Carriage Bintang is one of Malaysia's leading Mercedes-Benz dealers.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform