News

SATS issues $200m fixed rate notes

SATS issues $200m fixed rate notes

The notes have a fixed coupon rate of 2.88% per annum and are payable semi-annually.

Doctor Anywhere bags $38.44m Series B funding

It plans to expand its platform to more markets this year.

Ascendas Reit buys 25% stake in business park property for $102.91m

The property has a gross floor area of 68.835 sqm.

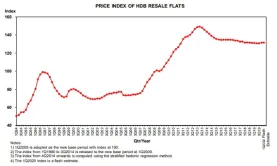

HDB resale price held steady in Q1

The pandemic may have negated the positive growth in the recent months.

Daily Markets Briefing: STI up 2.69%

Singtel led the gains amongst top active stocks with a 4.96% growth.

Daily Briefing: Securing grocery deliveries get difficult amidst COVID-19; Fintech startup MatchMove buys stake in e-commerce solutions provider

And agrifood tech firm DiMuto raises undisclosed funds from venture capital studio Latin Leap.

Singtel raises $2m for COVID-affected groups and frontliners

The group will provide care packages to support consumers and SMEs.

ComfortDelGro Taxi extends rental relief until September

The $80m move will push the business into the red for the fiscal year.

Court hearing for FLT-FCOT merger set on 3 April

FCOT will be delisted on 29 April.

Grab executives to take 20% pay cut

Voluntary employee donations will fund its partner relief initiatives.

Landlords urged to limit retail rents by turnover

This hopes to avoid permanent store closures as the pandemic hit stores’ sales.

Daily Markets Briefing: STI down 4.45%

Singtel saw the sharpest decline amongst top active stocks with a 5.84% fall.

Chart of the Day: Fewer Chinese buyers purchased condos in prime districts

This reflected a fall in the share of condos snagged by Chinese buyers in the city.

Daily Briefing: HOOQ files for liquidation; 2,300 students ask to return from overseas placement amidst COVID-19

And Switzerland-based software firm Netcetera opened its first office in Singapore.

UOBAM launches Singapore's first bond fund for retail investors

Underlying Fund focused on impact investing and stable income for investors.

SPH board and senior management to take pay cuts

SPH Reit grants rebate to businesses to reduce the impact of COVID-19. Singapore Press Holdings (SPH) board members will take a voluntary 10% reduction in directors' fees, whilst the salary of those in senior management will be cut by 5% starting April, according to an announcement on Thursday. SPH is the sponsor of SPH Real Estate Investment Trust (SPH Reit), which has also introduced pay cuts for its CEO and senior staff. In addition, SPH Reit will fully pass on its property tax rebate to its tenants to reduce the impact of Covid-19 on businesses, aiming to finalise the details of the enhanced tenants rebate scheme by April. This comes after Deputy Prime Minister Heng Swee Keat’s announcement that qualifying commercial properties will not pay property tax in 2020, whilst businesses in other non-residential properties will get a rebate of 30%. SPH Reit is also considering granting further rental rebates to retail and food and beverage businesses at malls. This is due to stricter measures that have been rolled out to minimise further spread of the novel coronavirus such as the closure of bars and entertainment venues till 30 April.

Singapore hotels' average occupancy down to 51%

Hotel rooms remain half-filled resulting in a 40% decline in revenue.

Advertise

Advertise

Commentary

Why Singapore businesses must focus on outvaluing, not just upskilling

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform