News

Wilmar's FY2018 profits dropped 5.7% to US$1.13b

Wilmar's FY2018 profits dropped 5.7% to US$1.13b

It blamed the African swine fever outbreak in China and weaker commodity prices.

Infant formula market dries up as mothers return to breastfeeding: report

Nine in 10 mothers in Singapore engaged in either partial or full breastfeeding in 2018.

Venture's profits slipped 0.7% to $370m in FY2018

It was hit by its customers’ product transitions and M&A activities.

Go-Jek partners with insurtech firm Gigacover to provide driver insurance

It will cover driver-partners for medical leave of up to 21 days and hospitalisation leave of up to 84 days.

ST Engineering clinches $813m aircraft maintenance contract with US operator

It will provide maintenance services for the customer’s 160 aircrafts starting 2020.

Daily Markets Briefing: STI up 0.07%

The additional China tariff announcement delay may boost local sentiment.

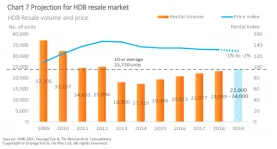

Chart of the Day: HDB resales could hit 24,000 units in 2019

Resale prices may slide further by 1-2%, whilst rents may decline by 1-3% in 2019.

Daily Briefing: Google unveils new space for SEA developers; BCA accelerator invests $6m to fuel Gov-PACT initiative

And HDB revealed that more than half of 2-room flexi flats are purchased by seniors.

Inflation eased to 1.7% in January

Slower growth in electricity and gas prices outweighed higher services inflation.

Singapore is the fifth preferred destination for Chinese property investment in 2018

The city saw US$650m in acquisitions across four deals in 2018.

Peace Centre / Peace Mansion up for collective sale at $688m

It could yield about 362,747 sqft of retail/commercial space and some 241,831 sqft of residential units. Peace Centre / Peace Mansion (PCPM) in Sophia Road is up for sale at $688m, JLL revealed. The mixed development commercial site located in the prime district 9 houses 99 retail/commercial units, 133 offices, 86 apartments and a carpark with 162 lots, totalling 319 strata lots in a 10-storey front podium block and a rear 32-storey tower. Under the 2014 Master Plan, the property has a site area of 76,617 sqft site is zoned for ‘commercial’ use and has a verified gross plot ratio (GPR) of about 7.89. The property could also be redeveloped up to a height of 55 m above mean sea level. An outline planning permission (“OPP”) from the Urban Redevelopment Authority has been obtained recently to redevelop the site up to the existing Gross Floor Area (“GFA”) of approximately 604,578 sq ft at an equivalent GPR of 7.89 for a mixed commercial and residential project. Based on the OPP, a new development comprising of 60% commercial GFA and 40% residential GFA could yield about 362,747 sqft of retail/commercial space and some 241,831 sqft of residential units (or about 240 units at an average size of 1,000 sqft, subject to relevant authority’s approval). According to JLL, more than 80% of the owners have consented to the collective sale and are expecting offers in excess of $688 million. An application for an in-principle approval for the lease top up to a fresh 99 years has also been made to the Singapore Land Authority and a reply is expected to be obtained soon. JLL noted that there is also no requirement for a Pre-Application Feasibility Study for the site based on enquiry with the Land Transport Authority (LTA). “At the owners’ minimum price of $688m, it reflects a land rate of approximately $1,474 psf ppr, before factoring in bonus balcony plot ratio for the residential component,” Tan Hong Boon, Executive Director at JLL, said. “This compares very favorably with transacted land sales in the vicinity as well as several other commercial and mixed use collective sale sites on the market now.”

UOB NIMs to widen by 3bps in FY19: analyst

The bank’s SGD loan-to-deposit ratio remains the highest amongst its peers.

Sembmarine clinches contracts worth $175m

It includes repair and modernisation works on 13 cruise ships.

Keppel-SPH buyout could strengthen M1's MVNO position

This could help the telco which is facing a decline in its mobile customer base, marked by a 4.1% to 1.96 million in Q4.

Can the utilities segment boost Sembcorp from earnings rut?

Its India operations reversed from a $58m loss in FY17 to a profit of $47m in 2018.

Daily Briefing: Japanese internet giant Recruit Holdings launches $33.75m fund for blockchain startups in Singapore; P2P lending platform Validus Capital clinches $20.52m in Series B funding round

And Changi's Prison Complex explores using facial recognition technology.

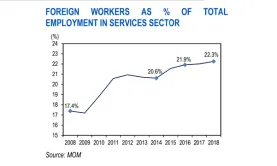

Chart of the Day: Foreign workers make up a fifth of the services sector

The tighter manpower rules will hit consumer and healthcare bottomlines by less than 4% by FY20.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform