News

DBS cost-to-income ratio to ease to 43% in 2019

DBS cost-to-income ratio to ease to 43% in 2019

Cost-to-income ratio will dip to 43% from 46.3% in 2018.

Foreign worker policies spur short-term pains for food, retail, and rentals

The dependency ratio ceiling for foreign workers will be cut from 40% to 35%.

StarHub's cybersecurity venture may wipe out $30m in staff cost savings

The firm's cybersecuty business was hit by a $12m NPAT loss in Q4.

Unsold residential units doubled to over 34,000 in 2018

This was driven by the softening en bloc sales.

Mapletree Industrial Trust receives SGX approval to raise $201m via private placement

The proceeds will partially fund the firm’s Tai Seng acquisition.

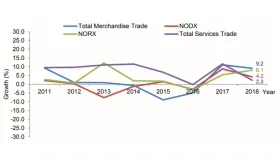

NODX slipped 10.1% in January

This is the worst NODX performance since October 2016.

Facebook and IMDA kick off accelerator programme

Eleven startups made up the first batch of Startup Station Singapore.

Singapore extends CHAS subsidies for chronic conditions

The subsidies will be extended to cover all Singaporeans regardless of income.

Taxi drivers could bear brunt of diesel tax hikes

Duties will be raised from $0.10 to $0.20 per litre.

Daily Briefing: Razer to close digital game store; Logistics startup Moovaz scores funds from Silicon Valley-based VC

And the first of four customised submarines designed for operations in Singapore is unveiled.

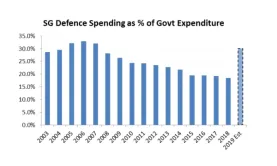

Chart of the Day: Singapore 2019 defence spending hits 12-year high

The government is allocating 30% of the budget to defence from 18.5% in 2018.

Daily Markets Briefing: STI up 0.81%

Don't expect gains today.

Frasers Property arm to buy stake in PGIM Real Estate AsiaRetail Fund for $356.4m

The 17.83% stake is equivalent to 94,013 shares.

ThaiBev Q1 profits ballooned 150.7% to $322.23m

The Thai economy continued to seal growth amidst the rise in private consumption.

DBS full-year profit surged 28% to $5.63b

Fee income hit $2.78b as led by card and wealth management.

4 in 5 SMEs expect more business incentives from Budget: survey

Firms aim to address in manpower and cost challenges.

Singapore total trade breaks $1t again after four years

But momentum could taper off as growth could slow down in 2019.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform